The Right Hire at the Right Time: My First Move as a Beginner Founder

I remember staring at a blank job posting, heart racing, wondering when—exactly—I should bring someone on board. As a first-time entrepreneur, I feared hiring too early would drain my funds, but waiting too long could cost me growth. I wasn’t just looking for help—I was looking for timing. This is the story of how I learned that in recruitment, when you act matters just as much as who you hire. It’s not just about skills; it’s about rhythm, readiness, and real talk. For women managing households, raising children, and often balancing side ventures or dreams of starting a business, this moment of decision carries extra weight. It’s not only about money—it’s about trust in your own judgment, confidence in your vision, and the courage to take the next step without knowing every outcome.

The Hiring Dilemma Every New Founder Faces

Starting a business from the ground up can feel like building a house while living inside it. Every wall needs framing, every wire must be connected, and yet life continues around you. For many first-time founders, especially those stepping into entrepreneurship after years of managing homes and families, the instinct is to do everything alone. There’s pride in self-reliance, a deep-seated belief that if you want something done right, you should do it yourself. But this mindset, while noble, becomes a liability when growth depends on delegation. The real dilemma isn’t whether to hire—it’s when to admit that you can’t do it all without sacrificing your health, your relationships, or your business’s potential.

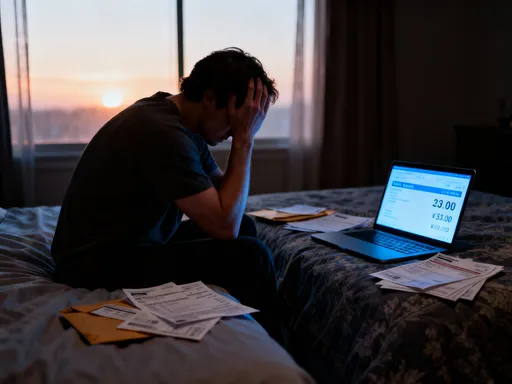

I held on for months, convinced I had to “earn” the right to bring someone in. I believed that hiring meant I was finally “successful enough” to afford help. That thinking kept me trapped in a cycle of overwork and underperformance. I was handling customer inquiries at midnight after putting the kids to bed, designing marketing materials during school pickups, and trying to plan strategy between grocery runs. What I didn’t realize then was that waiting wasn’t humility—it was hesitation disguised as discipline. The truth is, recognizing the need for help isn’t weakness; it’s one of the earliest signs of leadership. It means you’ve moved beyond survival mode and are thinking strategically about scale.

What changed my perspective was a simple question: What would happen if I didn’t hire? The answer was clear—nothing would grow. My business would remain exactly as it was: dependent on my energy, limited by my hours, and vulnerable to burnout. That realization shifted my thinking from “Can I afford to hire?” to “Can I afford not to?” And once I reframed it that way, the decision became less emotional and more financial. Every hour I spent on low-leverage tasks was an hour lost on revenue-generating activities. The cost wasn’t just in time; it was in missed opportunity. The right hire at the wrong time might feel like a burden, but the right hire at the right time? That’s leverage. It’s the difference between working in your business and working on it.

Signs You’re Ready to Recruit (Even on a Tight Budget)

You don’t need a six-figure revenue to know it’s time to bring someone on board. What you need is clarity. The signals are often subtle at first—an email left unanswered for two days, a client comment about slow response times, a recurring task that steals three hours from your week. These aren’t just inconveniences; they’re symptoms of a system reaching capacity. I ignored them for too long, telling myself it was temporary, that I could “push through.” But when I started missing deadlines on deliverables I had promised clients, I knew I could no longer pretend the problem wasn’t real.

Readiness to hire isn’t about having deep pockets or outside funding. It’s about recognizing where your time is being consumed and where your energy is being drained. For me, it was administrative work—scheduling calls, managing invoices, organizing files. None of it required my expertise, yet it demanded my attention. I was paying myself in stress, not in progress. Once I admitted that, I opened the door to change. I didn’t need a full-time employee. I needed a solution. So I started small—I outsourced one function. Just one. I hired a virtual assistant for ten hours a week to handle scheduling and email filtering. The impact was immediate. My mornings became clearer. My focus sharpened. And for the first time, I had mental space to think about growth instead of just getting through the day.

That small step taught me an essential lesson: readiness isn’t a financial threshold. It’s a functional one. When you can no longer maintain quality, consistency, or customer satisfaction on your own, you’re ready. You don’t have to hire someone to “do everything.” You just need to identify the bottleneck—the one task that, if removed, would free you to do what only you can do. For many women entrepreneurs, that bottleneck is often invisible because it’s woven into the rhythm of daily life. But once you see it, the path forward becomes clearer. And the best part? You don’t need to spend a lot to start. You need to spend wisely.

The Cost of Waiting: How Delayed Hiring Hurts Growth

I used to believe that saving money meant delaying hires as long as possible. I thought every dollar I didn’t spend on payroll was a dollar safely tucked away. But I was wrong. What I saved in salary, I lost in momentum. Every week I waited to delegate, I gave up opportunities to scale, to serve more clients, to refine my offer. Projects stalled because I didn’t have time to move them forward. My attention was split, my energy scattered. I wasn’t protecting my business by holding off—I was holding it back.

Research consistently shows that early-stage companies that time their hires well grow faster and achieve profitability sooner. A study by the National Bureau of Economic Research found that firms that hire key roles at the right stage are 30% more likely to scale successfully within three years. That doesn’t mean hiring early is always right, but hiring strategically is. When I finally admitted that my hesitation was costing me more than the salary would, I shifted my mindset from cost to investment. I wasn’t just paying someone to take work off my plate—I was buying back my most valuable asset: time. And time, when reinvested in growth, generates returns.

The real risk wasn’t spending money. The real risk was standing still. Every day I delayed, my competitors moved forward. Every client who waited too long for a response considered alternatives. Every idea I didn’t pursue because I was too busy became a missed opportunity. The truth is, a business can’t grow beyond the capacity of its founder unless that founder learns to delegate. And waiting too long to hire doesn’t make you frugal—it makes you fragile. The illusion of safety is dangerous. It makes you believe you’re protecting your business when you’re actually limiting it. The moment I stopped seeing hiring as an expense and started seeing it as an accelerator was the moment my business began to change.

Picking the Right Role to Fill First

When I finally decided to hire, I almost made a critical mistake. I was ready to bring on a general assistant—someone who could “help with everything.” It seemed practical. But after talking to a mentor, I paused. She asked me a simple question: “What one task, if you never had to do it again, would give you the most freedom?” I thought about it and realized it wasn’t customer service or marketing or even bookkeeping. It was calendar management. I was spending nearly 20 hours a week juggling meetings, rescheduling calls, and chasing confirmations. It was time-consuming, repetitive, and added zero value to my business. Yet it controlled my days.

So I made a different choice. Instead of hiring a generalist, I hired someone specifically for scheduling and administrative coordination. That single decision transformed my workflow. Suddenly, my week was structured. I had blocks of uninterrupted time for deep work. I stopped double-booking and missing calls. My stress levels dropped. More importantly, I gained clarity. With my calendar managed, I could finally focus on sales, strategy, and client relationships—the areas that actually drove revenue. That first hire wasn’t about convenience. It was about leverage. It multiplied my time, my impact, and my confidence.

The lesson here is simple but powerful: don’t hire for what feels urgent. Hire for what creates the most strategic advantage. The right first role isn’t always the most visible one. It’s the one that, once filled, unlocks your ability to do what only you can do. For many women, this means stepping back from the details and stepping into the vision. It means trusting that someone else can handle the tasks you’ve been doing out of habit, not necessity. And it means redefining success not as doing everything, but as building something that doesn’t depend on you doing everything.

Smart Ways to Hire Without Breaking the Bank

I didn’t have venture capital backing or a large savings account. I was funding my business from revenue, and every dollar counted. So when I decided to hire, I had to be creative. I explored freelancers, part-time contractors, and even equity-based arrangements. Each had pros and cons. Freelancers offered flexibility and low commitment, but often lacked long-term alignment. Part-timers provided consistency without the full cost of a salaried employee, but required more management. Equity roles attracted passionate talent, but introduced complexity in ownership and expectations.

What worked best for me was a hybrid approach. I started with a short-term contract—a 30-day trial with a virtual assistant based overseas. The rate was a fraction of what I would have paid locally, and the platform made it easy to find vetted professionals. I set clear goals: organize my inbox, manage my calendar, and handle client onboarding emails. At the end of the month, I evaluated performance, communication, and reliability. Because it was a trial, I wasn’t locked in. If it didn’t work, I could walk away with minimal loss. But it did work. In fact, it exceeded expectations. She brought systems I didn’t know I needed, like automated email templates and meeting confirmation workflows.

The goal wasn’t to find the cheapest option. It was to find the smartest one—one that was sustainable, scalable, and aligned with my business stage. I learned that hiring doesn’t have to mean full-time, long-term employment. It can mean strategic outsourcing, fractional roles, or project-based partnerships. For women balancing budgets at home and in business, this flexibility is empowering. It means you don’t have to choose between growth and financial safety. You can have both, as long as you hire with intention. The key is to start small, test assumptions, and scale only when the value is proven.

Timing the Market: Hiring During Economic Shifts

One of the most unexpected advantages I discovered was timing my hire to broader economic conditions. When the economy slowed and layoffs increased, I noticed a shift in the talent pool. Skilled professionals who might not have considered freelance or contract work were suddenly open to new opportunities. Rates were more flexible, and candidates were more motivated to prove their value. Instead of pulling back, I adjusted my timeline and moved forward. I found a talented operations manager who had recently left a corporate role and was eager to work remotely. She brought experience I couldn’t have afforded in a stronger market.

Conversely, during periods of economic growth, I learned to move faster. When demand for freelancers spiked, I knew delays could mean losing top candidates to other offers. I streamlined my hiring process, prepared job descriptions in advance, and set clear decision timelines. I also built relationships with talent platforms so I could act quickly when needed. Staying aware of these external rhythms helped me make smarter, more strategic decisions. Hiring isn’t just an internal calculation—it’s also about reading the market. Just as you wouldn’t invest in stocks without understanding market trends, you shouldn’t hire without understanding labor trends.

For women who manage household budgets with care, this kind of strategic timing comes naturally. You know when to buy groceries on sale, when to wait for seasonal discounts, and when to invest in quality that lasts. The same principles apply to hiring. It’s not about spending less—it’s about spending wisely. And sometimes, the best time to hire isn’t when you feel most secure, but when the conditions are most favorable. Economic shifts aren’t just risks—they can be opportunities, if you’re prepared to act.

Building a Foundation for Future Hiring Success

My first hire taught me more than how to delegate. It taught me how to build systems. I hadn’t thought about onboarding, performance reviews, or feedback loops. I assumed that if I hired the right person, everything would fall into place. But without structure, even great hires can struggle. I quickly realized that clarity was my most important tool. I defined roles, set expectations, and created simple check-ins every two weeks. I tracked key tasks and celebrated progress. What started as a trial became a long-term partnership because we both knew what success looked like.

That experience became the blueprint for future hires. I stopped reacting to crises and started planning hires like milestones. I mapped out when I would need support based on projected growth, not just current stress. I built a talent pipeline, maintained relationships with contractors, and kept job descriptions updated. I also learned to trust my instincts. Not every candidate with the perfect resume was the right fit. Chemistry, communication style, and shared values mattered just as much as skills. For women who have spent years managing teams of children, households, and volunteers, these soft skills come naturally. We know how to read people, resolve conflicts, and create harmony. Those abilities are just as valuable in business as they are at home.

Today, hiring isn’t something I fear. It’s something I plan for. I see it as a sign of strength, not strain. The right timing isn’t luck—it’s a skill built through experience, observation, and intention. And the earlier you start developing it, the faster your business can grow. Each hire becomes a multiplier, not a burden. Each decision strengthens your foundation. And each step forward reinforces the truth: you don’t have to do it all to succeed. You just have to know when to ask for help.

Mastering the Rhythm of Recruitment

Looking back, my biggest breakthrough wasn’t finding the perfect person. It was learning when to look. Hiring isn’t just a financial decision; it’s a strategic one. It requires listening to your business, watching the signals, and acting with confidence. For beginner entrepreneurs, especially women who have spent years making smart, careful choices for their families, this skill comes with a unique advantage. You already know how to balance risk and reward, how to plan for the long term, and how to make the most of limited resources.

The right hire, at the right time, doesn’t just help you survive. It helps you rise. It frees you from the grind and positions you to lead. It transforms your business from a one-person operation into a sustainable, scalable venture. And it reminds you that growth isn’t about doing more—it’s about doing what matters. So if you’re standing at that crossroads, staring at a blank job post, wondering if now is the time, let this be your nudge. Don’t wait until you’re overwhelmed. Don’t wait until you’re burning out. Pay attention to the signs. Trust your instincts. And take the step.

Because timing isn’t just about money. It’s about momentum. It’s about vision. And it’s about believing that your business—and you—are worth the investment.