How I Keep My Money Safe When Life Goes Off Track

We’ve all had moments when things suddenly go wrong—a car breaks down, a job ends, or a bill arrives out of nowhere. In those times, your finances can make the crisis worse—or help you stay calm and in control. I learned this the hard way. What I discovered wasn’t about getting rich, but about avoiding disaster. It’s not perfect, but it’s real, practical, and it’s what keeps me from falling apart when emergencies hit. Financial stability doesn’t come from sudden windfalls or complex investment strategies. It comes from preparation, consistency, and knowing how to protect what you already have. This is the system I built—not in a moment of clarity, but in the quiet aftermath of stress, sleepless nights, and tough choices. And it’s what I rely on when life, once again, decides to take an unexpected turn.

The Wake-Up Call: When My Emergency Hit

It started with a phone call on a Tuesday morning. The voice on the other end was polite but firm: my position was being eliminated due to restructuring. I was not alone—several others were let go the same day. But standing in my kitchen with the phone in my hand, I felt completely isolated. My first thought wasn’t about unemployment benefits or job hunting. It was about the mortgage payment due in 11 days. Then the car insurance. Then the school fees for my daughter. Suddenly, the steady rhythm of my life felt like it had skipped a beat—and I didn’t know if it would ever find its way back.

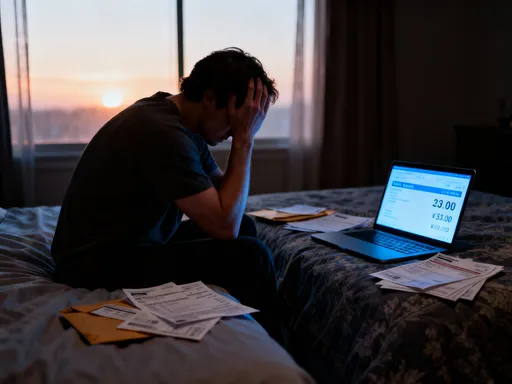

In the weeks that followed, I made choices I never thought I’d have to make. I delayed paying a medical bill. I stopped contributing to my retirement account. I dipped into savings meant for home repairs. Each decision brought short-term relief but long-term anxiety. I wasn’t just dealing with a job loss—I was watching my sense of security unravel. I had always considered myself financially responsible. I paid my bills on time, avoided credit card debt, and even saved a little each month. But when real pressure hit, I realized my habits weren’t enough. I had no buffer. No plan. No clear idea of how to navigate a true financial storm.

The emotional toll was just as heavy as the financial one. I felt shame, even though I hadn’t done anything wrong. I worried about what others would think. I stopped going out with friends because I couldn’t afford to split the check. I started waking up at 3 a.m., mentally calculating how many months I could last on my remaining savings. It wasn’t until I sat down with a financial counselor that I understood the real issue: I had been managing my money, but I hadn’t been protecting it. That distinction changed everything. It wasn’t about earning more or spending less—it was about building resilience. And resilience, I learned, starts long before the crisis arrives.

Building Your Financial Seatbelt: The Emergency Fund That Actually Works

An emergency fund is often described as three to six months of living expenses. That’s a helpful guideline, but it can feel overwhelming—especially if you’re starting from zero. The truth is, the perfect emergency fund isn’t defined by a specific dollar amount. It’s defined by peace of mind. It’s the difference between reacting in panic and responding with clarity when something goes wrong. I used to think I couldn’t afford to save. But I now know I couldn’t afford not to. The goal isn’t to reach a finish line—it’s to create a safety net that grows with you, adapts to your life, and actually gets used when needed.

My first step was redefining what counted as an emergency. Too many people drain their savings on things like vacations, holiday shopping, or even routine car maintenance. These are predictable expenses, not emergencies. A true emergency is something sudden, unavoidable, and necessary—like a medical procedure, a home repair after a storm, or the loss of income. By setting clear boundaries, I protected my fund from being slowly eroded by everyday spending. I opened a separate savings account at a different bank, one that didn’t have a debit card or easy transfer options. The small friction made it harder to dip in casually. That simple step made a big difference.

Next, I focused on consistency, not size. Instead of aiming to save $10,000 overnight, I started with $25 a week—less than the cost of eating out twice. I set up automatic transfers so the money moved before I even saw it in my checking account. Over time, that small amount grew. When I got a tax refund or a bonus, I directed a portion—never all—into the fund. I celebrated milestones, not perfection. Reaching $1,000 felt like a victory. So did hitting three months of basic expenses. Each milestone reinforced the habit and built confidence.

Today, my emergency fund covers about five months of essential costs—housing, food, utilities, insurance, and transportation. It’s not extravagant, but it’s enough to give me breathing room. I’ve used it twice since building it: once when my refrigerator failed, and again during a period of reduced income. Each time, I replenished it gradually, treating it like a loan to myself. The fund isn’t static. It evolves as my life changes. If my rent goes up, I adjust the target. If I take on a new financial responsibility, I reassess. The key is to keep it relevant, protected, and accessible—because when life goes off track, your emergency fund should be the one thing that keeps you on course.

Cutting the Risk Lines: Smart Ways to Reduce Financial Exposure

One of the most dangerous financial assumptions is that things will stay the same. We assume our job will continue, our health will hold, and our income will remain steady. But life rarely follows a straight line. The people who weather financial storms best aren’t always the ones with the highest salaries—they’re the ones who’ve reduced their exposure to risk. After my job loss, I took a hard look at where I was most vulnerable. What I found surprised me. I wasn’t just dependent on one income. I was also carrying high-interest debt, had no side income, and was one missed paycheck away from falling behind on bills. These weren’t flaws in my character—they were structural weaknesses in my financial setup.

The first change I made was tackling high-interest debt. I had two credit cards with balances, one at 19% interest and another at 24%. Minimum payments were eating up nearly $300 a month, and the balances weren’t going down. I used a balance transfer offer with a 0% introductory rate to consolidate the debt, then committed to paying it off within 12 months. I stopped using the cards for new purchases and built a small spending buffer to avoid relying on credit for emergencies. Eliminating that debt freed up cash flow and reduced a major source of stress.

Next, I worked on income diversification. I didn’t quit my job or start a side hustle out of desperation. Instead, I looked for ways to use skills I already had. I began offering freelance writing services a few hours a week. It wasn’t much at first—maybe $150 a month—but it was enough to cover a utility bill or add to my emergency fund. Over time, it grew. The goal wasn’t to replace my full income, but to create a secondary stream that could help if the primary one disappeared. Even if it only covered groceries, it would buy me time and reduce pressure.

I also reviewed my recurring expenses with fresh eyes. I renegotiated my internet bill, switched to a cheaper cell phone plan, and canceled subscriptions I rarely used. These weren’t drastic cuts—they were smart optimizations. The savings weren’t life-changing on their own, but they added up. More importantly, they gave me a sense of control. I wasn’t just reacting to my income—I was actively managing my financial footprint. Reducing exposure isn’t about living with less. It’s about making your financial life more resilient by removing unnecessary pressure points. When you have fewer fixed costs and more flexibility, you’re better equipped to handle whatever comes next.

Insurance That Makes Sense—Not Just Noise

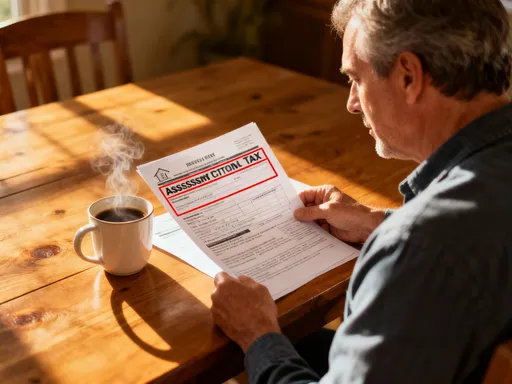

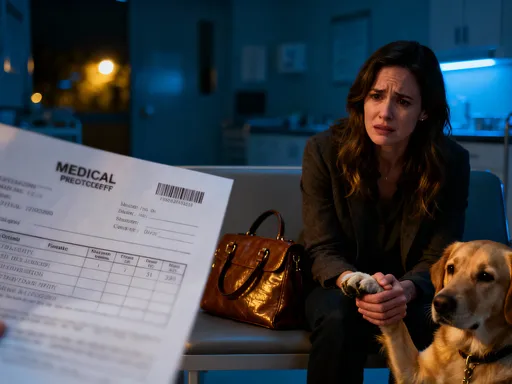

Insurance is one of the most misunderstood tools in personal finance. Some people avoid it entirely, seeing it as a waste of money. Others overpay for coverage they don’t need, lured by aggressive sales tactics or fear-based messaging. The truth is, insurance isn’t about preventing every possible problem. It’s about protecting against catastrophic losses—the kind that could wipe out years of savings in an instant. After my job loss, I reviewed every policy I had and asked one simple question: Does this protect against a risk I can’t afford to bear on my own?

Health insurance was the most critical. I was fortunate to have access to COBRA, but the premiums were high. I explored marketplace options and found a plan with a slightly higher deductible but significantly lower monthly cost. It still covered essential services, preventive care, and hospitalization—what I truly needed. I accepted that I’d pay more out of pocket for minor issues, but I wouldn’t face financial ruin if something serious happened. That balance made sense for my situation.

I also reviewed my auto and home insurance. I increased my deductibles slightly to lower premiums, knowing I had an emergency fund to cover the difference if needed. I made sure my coverage reflected the actual value of my belongings, not inflated estimates. I removed unnecessary add-ons like rental car coverage I could manage without. These small adjustments saved over $400 a year without sacrificing real protection.

One of the most overlooked forms of insurance is disability coverage. Many people assume they’re protected by workers’ comp or savings, but neither is reliable in the long term. I didn’t have employer-provided disability insurance, so I researched individual policies. The premiums were modest—about $50 a month—and the benefit replaced a portion of my income if I became unable to work due to illness or injury. It wasn’t glamorous, but it was practical. I also reviewed my life insurance, ensuring it covered final expenses and provided some support for my family without over-insuring. The goal wasn’t to maximize coverage—it was to match it to real needs. Good insurance doesn’t eliminate risk. It manages it wisely, so you’re not gambling with your future.

Cash Flow Control: How to Keep Money Moving When Income Stalls

When income drops, the instinct is often to freeze—stop spending, stop moving, wait for things to improve. But financial survival isn’t about freezing. It’s about managing flow. Just like a car needs oil to keep the engine running, your finances need cash flow to stay functional. During my period of unemployment, I created a temporary budget focused on three priorities: keeping a roof over my head, maintaining basic utilities, and protecting my health. Everything else was negotiable. I listed every expense and ranked them by necessity. The goal wasn’t austerity—it was sustainability.

I contacted every creditor and service provider with a simple message: I’ve had a change in income, and I’d like to discuss payment options. To my surprise, most were willing to help. My mortgage lender offered a forbearance plan. My utility company set up a payment extension. My internet provider reduced my rate for six months. These weren’t handouts—they were options I had to ask for. No one called me to offer them. By being proactive, I avoided late fees, penalties, and damage to my credit score.

I also explored temporary income sources. I sold unused household items online. I took on short-term projects through my freelance network. I even rented out a spare room for a few weeks. These weren’t long-term solutions, but they kept money coming in and helped me maintain momentum. I tracked every dollar, knowing that small inflows could prevent big setbacks. I also paused non-essential savings and investments, redirecting that money to immediate needs. This wasn’t failure—it was strategy. Protecting your financial foundation sometimes means temporarily setting aside other goals.

The key was staying in motion. Panic leads to poor decisions—like maxing out credit cards or selling investments at a loss. But a clear, controlled approach allows you to make thoughtful choices. I reviewed my budget weekly, adjusted as needed, and kept communication open with everyone involved. Cash flow control isn’t about having plenty of money. It’s about making the money you have work as hard as possible. When income stalls, the goal isn’t to feel normal—it’s to stay stable, maintain dignity, and keep moving toward recovery.

The Mindset Shift: From Reactive to Resilient

Financial resilience starts in the mind. No tool, strategy, or product works if you’re operating from a place of fear or denial. After my job loss, I realized I had been living in a state of financial complacency. I assumed stability was permanent. I avoided uncomfortable conversations about money. I told myself I’d “deal with it later.” That mindset left me unprepared. The shift didn’t happen overnight. It came from repeated choices to face reality, accept uncertainty, and focus on what I could control.

I began by reframing setbacks as part of the process, not proof of failure. Losing a job wasn’t a personal flaw—it was a risk inherent in working life. Medical bills weren’t a sign of poor planning—they were unpredictable events. By removing judgment, I could respond more calmly and effectively. I also practiced gratitude for what I still had: a home, a support network, and the ability to adapt. This wasn’t about ignoring stress, but about balancing it with perspective.

I started planning for setbacks, not just goals. I asked myself: What if my car breaks down? What if I get sick? What if the economy slows? These weren’t meant to fuel anxiety, but to prompt preparation. I built checklists, gathered contact information, and reviewed my insurance policies annually. I also limited exposure to financial noise—dramatic headlines, fear-based podcasts, and get-rich-quick schemes. Instead, I focused on trusted sources and practical steps.

Emotional discipline became as important as budgeting. I learned to pause before making money decisions, especially under pressure. I wrote down my options, consulted a trusted friend, and waited 24 hours before acting. This simple habit prevented impulsive moves. Resilience isn’t the absence of crisis. It’s the ability to move through it with intention. When you cultivate the right mindset, financial tools stop feeling like burdens and start feeling like allies.

Putting It All Together: A Practical Plan That Stays with You

What I’ve learned isn’t a shortcut to wealth. It’s a framework for stability—a way to protect what you’ve worked for and move through hard times with dignity. The real power comes from how these pieces fit together. Your emergency fund isn’t just savings—it’s the foundation that gives you time. Risk reduction isn’t just cutting costs—it’s about building flexibility. Insurance isn’t just paperwork—it’s a safety net for the worst-case scenarios. Cash flow control isn’t just budgeting—it’s the skill of keeping things moving when pressure mounts. And mindset isn’t just positive thinking—it’s the discipline to act when others freeze.

I review my financial plan every six months. I check my emergency fund balance, reassess my insurance needs, and update my budget. I look for new risks and adjust my strategies. This isn’t a one-time project. It’s an ongoing practice. I’ve also shared parts of this system with friends and family, not as advice, but as experience. One friend started her emergency fund with $10 a week. Another renegotiated her mortgage and saved hundreds a month. Small steps lead to real change.

The goal isn’t perfection. It’s preparedness. You don’t need to have everything figured out to begin. You just need to start—wherever you are, with whatever you have. Build your seatbelt. Cut the risk lines. Choose insurance that fits. Control your cash flow. Shift your mindset. Do it not because you’re afraid, but because you value stability, peace, and the ability to face the unexpected without breaking. Life will go off track. That’s not a matter of if, but when. But with the right plan, you won’t have to go off track with it. You’ll be ready—not to avoid the storm, but to walk through it, steady and sure.