How I Navigated Immigration Finances Without Losing My Mind

Moving to a new country? The excitement can quickly fade when money issues hit. I learned this the hard way—facing hidden fees, frozen accounts, and tax surprises. What seemed like a solid plan fell apart in months. But after fixing my mistakes, I built a smarter, safer system. In this article, I’ll walk you through the real financial risks in immigration prep—and how to avoid them like I eventually did. It’s not about getting rich. It’s about staying safe, staying legal, and keeping what you’ve worked for. Financial stability during immigration isn’t guaranteed by hope or hustle. It comes from preparation, awareness, and a clear-eyed view of how money moves across borders. For women managing households, supporting families, and balancing long-term goals, this journey demands both courage and caution. Let’s explore how to protect your hard-earned resources while building a secure future in a new home.

The Hidden Cost of Starting Over: Why Immigration Is a Financial Minefield

Immigration is often framed as a fresh start—an opportunity for better education, career growth, or quality of life. But beneath the promise lies a complex financial reality that many overlook until it's too late. The process of relocating isn’t just about packing suitcases and booking flights; it’s a full-scale financial reset. Every asset, account, and income stream must be reevaluated under new legal, tax, and banking systems. This transition creates vulnerabilities, especially when emotions run high and decisions are made under pressure. What feels like a necessary shortcut today—like liquidating property quickly or skipping professional advice—can lead to long-term financial setbacks.

One of the most common yet underestimated risks is currency conversion. When moving money across borders, exchange rates fluctuate daily, and banks or transfer services often apply hidden markups. A family transferring $100,000 might unknowingly lose 3% to 5% in unfavorable rates or service fees—amounting to thousands of dollars lost before the funds even arrive. These losses compound when transfers happen in stages, each with its own fee structure. Moreover, many immigrants assume their domestic banking habits will carry over seamlessly, only to discover that foreign banks have different rules, deposit insurance limits, and access protocols. In some cases, accounts have been temporarily frozen due to compliance checks, leaving families without access to essential funds during critical settlement periods.

Tax liabilities represent another major blind spot. Many countries tax residents on worldwide income, meaning that even after relocation, individuals may still owe taxes in their home country if they haven’t formally severed tax residency. At the same time, the destination country may begin taxing incoming funds or investment income. Without proper planning, this dual exposure can result in double taxation—a situation that erodes savings rapidly. For example, pension withdrawals or rental income from properties left behind may trigger unexpected reporting requirements or penalties if not declared correctly. Misclassifying income or failing to understand tax treaties can lead to audits, fines, or even legal complications.

Asset liquidation under pressure is another costly mistake. When families feel urgency to sell homes, vehicles, or businesses before departure, they often accept lower offers or rush into transactions without proper valuation. Real estate, in particular, can take months to sell at fair market value, yet emotional stress pushes some to offload property below worth just to “get it done.” This not only reduces available capital but also limits options upon arrival, where housing costs may already be high. Additionally, closing local financial accounts seems straightforward, but forgotten accounts can generate maintenance fees, incur tax reporting obligations, or become dormant—requiring costly recovery efforts later.

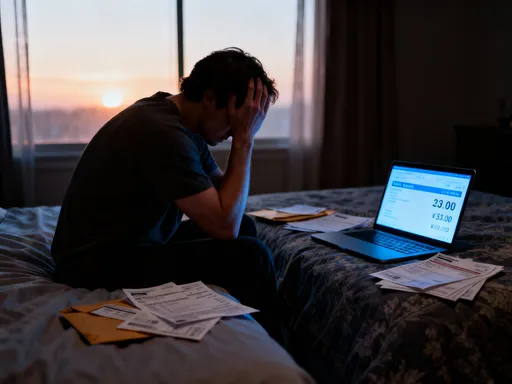

The emotional weight of relocation amplifies these financial risks. Decision fatigue sets in when managing visas, schools, housing, and cultural adaptation—all while trying to maintain financial control. Women, who often bear the primary responsibility for household management, face added pressure to ensure stability for children and partners. In this state, it’s easy to prioritize immediate needs over long-term strategy, such as choosing convenience over cost-efficiency in banking or skipping financial reviews to focus on more urgent logistics. Awareness is the first defense. Recognizing that immigration is not only a personal journey but a financial event of significant magnitude allows for more deliberate, informed choices. By treating the move as a structured financial transition—not just a lifestyle change—families can avoid preventable losses and build a stronger foundation from day one.

Building Your Financial Firewall: Protecting Assets Before You Move

Just as a house needs a strong foundation, a successful immigration journey requires a solid financial firewall built before departure. This proactive phase is where the most protection can be achieved, minimizing exposure to loss, fraud, or regulatory missteps. The goal isn’t to eliminate risk entirely—no system can do that—but to create layers of security that absorb shocks and preserve wealth. A well-structured pre-move plan includes asset diversification, jurisdictional planning, and strategic timing of transactions. These steps may seem technical, but they are essential for maintaining control over what you’ve worked hard to build.

One of the most effective strategies is diversifying holdings across multiple jurisdictions. Keeping all assets in one country increases vulnerability to political, economic, or regulatory changes. By spreading investments across stable financial systems—such as holding cash in a globally recognized currency, maintaining international brokerage accounts, or investing in real estate in more than one region—families reduce their dependence on any single economy. This doesn’t mean speculative investing; rather, it means thoughtful allocation based on stability, accessibility, and long-term growth potential. For instance, holding part of your savings in U.S. dollars or euros can provide a hedge against currency devaluation in your home country, especially if it experiences inflation or capital controls.

Equally important is verifying international banking access well in advance. Not all banks allow non-residents to open accounts, and those that do often require extensive documentation, including proof of address, income sources, and immigration status. Some institutions may also impose restrictions on incoming transfers or require in-person visits to activate services. To avoid delays, it’s wise to research and initiate relationships with potential banks in the destination country at least six to twelve months before moving. This includes understanding their online banking capabilities, customer support in your preferred language, and compatibility with international wire systems like SWIFT. Opening an account while still a resident of your home country may not be possible, but gathering information and preparing documents early ensures smoother onboarding once you arrive.

Structuring withdrawals and transfers strategically can significantly reduce financial exposure. Large, sudden movements of money can trigger anti-money laundering (AML) alerts, leading to temporary holds or investigations. Instead, consider staggering transfers over time, aligning them with expected expenses in the new country. For example, transferring funds in phases—first for housing deposits, then for living expenses, followed by investment allocations—can appear more natural to financial institutions and reduce scrutiny. Additionally, timing matters when selling assets. Selling property or investments during periods of market strength increases returns, while avoiding fire sales preserves capital. Consulting with a financial advisor familiar with cross-border transitions can help identify optimal windows for action, ensuring that decisions are based on data, not desperation.

Legal and tax advisors play a crucial role in mapping compliant pathways. They help interpret tax treaties, determine residency rules, and structure asset transfers to minimize liabilities. Their guidance is particularly valuable when dealing with retirement accounts, trusts, or business ownership, which may have special reporting or taxation rules across borders. Engaging professionals early allows for comprehensive planning, including estate considerations and inheritance laws in both countries. While hiring experts involves upfront costs, the savings in avoided penalties, lost interest, or legal complications far outweigh the investment. Think of them as navigators in uncharted territory—your best chance of reaching your destination safely.

A key component of the financial firewall is creating a buffer zone—typically six to twelve months’ worth of living expenses held in a liquid, accessible form. This fund acts as a safety net during the transition period when income may be interrupted, jobs are not yet secured, or unexpected costs arise. Ideally, this emergency reserve should be held in a stable currency and available through multiple access points, such as a debit card linked to an international account or a portion kept in cash for immediate needs. Having this cushion reduces the pressure to make hasty financial decisions and allows time to settle, find employment, and understand the local cost of living. Protection begins long before the plane takes off. By building a financial firewall in advance, families gain not just security, but peace of mind—the kind that lets you focus on what truly matters: building a new life together.

Banking Across Borders: Avoiding the Cash Trap

One of the most persistent myths in immigration is that your money will follow you as easily as you do. The truth is far more complicated. Banking systems are not designed for seamless international mobility. Each country has its own regulations, deposit insurance frameworks, and compliance protocols, which can create barriers for newcomers trying to access their own funds. Many immigrants arrive with savings, only to find that transferring or withdrawing money takes longer than expected—or worse, becomes temporarily impossible due to account freezes or documentation gaps. Understanding these limitations before moving is critical to avoiding what’s known as the “cash trap”: a situation where you have money, but cannot use it when you need it most.

Deposit insurance varies widely between countries. In some nations, government-backed insurance covers only a portion of deposits—often up to a certain limit per account or per institution. If you hold more than that threshold, the excess amount is unprotected in the event of bank failure. For families relocating with significant savings, this means spreading funds across multiple banks or accounts may be necessary to ensure full coverage. Additionally, not all countries offer deposit insurance at all, or their programs may not extend to non-residents. Without this protection, even a stable-looking bank can pose risks, especially in economies with less robust financial oversight. Researching the deposit insurance policies of your destination country—and confirming whether they apply to new residents—is a vital step in safeguarding your capital.

Account freezes are another common issue, often triggered by compliance checks. International wire transfers, especially large ones, are subject to anti-money laundering (AML) and know-your-customer (KYC) regulations. Banks may flag incoming funds as suspicious if they lack proper documentation, such as proof of source of funds, tax clearance, or immigration status. In some cases, funds can be held for weeks while the bank investigates, leaving families without access to essential money during the critical early months of settlement. To prevent this, it’s important to maintain detailed records of all transactions, including sale agreements, tax filings, and bank statements. Providing these documents proactively to your new bank can speed up verification and reduce delays.

Setting up dual banking relationships—one in your home country and one in your destination—can provide continuity during the transition. This allows you to manage remaining obligations (like mortgage payments or utility bills) from abroad while establishing a local presence. However, maintaining foreign accounts isn’t always simple. Some countries impose restrictions on non-residents holding domestic accounts, requiring periodic visits or limiting transaction types. Others may tax interest earned on foreign accounts, even after relocation. To navigate these rules, choose banks with strong international networks and multilingual support. Institutions that specialize in serving expatriates or immigrants often have streamlined processes and clearer communication, making it easier to manage accounts from afar.

Liquidity management is equally important. While it’s tempting to carry large amounts of cash for initial expenses, this poses security risks and may attract unwanted attention at customs. Most countries have reporting requirements for large sums of cash entering or leaving the country—typically above $10,000 or equivalent. Failing to declare can result in confiscation or legal consequences. Instead, use secure electronic transfer methods, such as bank wires or licensed money transfer services, which provide traceability and protection. Pre-arranging a local bank account, even if it’s initially empty, gives you a destination for incoming funds and helps establish financial credibility in your new community.

Choosing reliable institutions requires careful evaluation. Look for banks with a history of stability, transparent fee structures, and responsive customer service. Avoid lenders offering unusually high interest rates or promising fast account openings with minimal documentation—these can be signs of predatory practices or weak compliance standards. Read reviews, ask for recommendations from other immigrants, and verify the bank’s standing with national financial regulators. A trustworthy bank may not offer the flashiest services, but it will protect your money and treat you fairly over time. Access to your own funds should never be a gamble. By understanding cross-border banking realities and planning accordingly, you can avoid the cash trap and maintain control over your financial life from the very beginning.

Tax Tangles: Staying on the Right Side of Two Systems

Taxation is one of the most complex and consequential aspects of immigration. Unlike physical borders, tax boundaries don’t always align with geography. Moving to a new country doesn’t automatically end your tax obligations in your home country, nor does it immediately grant you full benefits in the new one. Tax residency is a legal status determined by specific criteria—such as the number of days spent in a country, employment location, or family ties—not simply by holding a visa or renting an apartment. Misunderstanding this distinction can lead to serious consequences, including double taxation, penalties, or loss of benefits. Navigating this dual responsibility requires clarity, documentation, and often, professional guidance.

Double taxation occurs when two countries claim the right to tax the same income. This can happen if you are considered a tax resident in both your home and destination countries during the transition year. For example, earning rental income from a property in your home country while also receiving a salary in your new country may trigger tax bills in both places. Fortunately, many nations have tax treaties designed to prevent this overlap. These agreements typically allocate taxing rights based on where income is sourced or where the taxpayer is primarily resident. However, benefiting from a treaty requires proper filing, disclosure, and sometimes a certificate of residency from one or both governments. Simply assuming you’re exempt because a treaty exists is not enough—you must actively claim the benefit through correct reporting.

Undeclared foreign income is another major risk. Many countries require residents to report worldwide income, including interest, dividends, pensions, and capital gains from assets held abroad. Failure to disclose can result in steep penalties, interest charges, or even criminal investigation in extreme cases. Some governments have strengthened enforcement through automatic exchange of financial information under agreements like the Common Reporting Standard (CRS), which allows tax authorities to access data on foreign accounts held by their residents. This means that hiding assets offshore is no longer feasible for most individuals. Instead, the focus should be on transparency—declaring all income accurately and paying the appropriate taxes in the right jurisdiction.

Determining tax residency status is a foundational step in compliance. Countries use different rules: some base it on physical presence (e.g., 183 days per year), while others consider economic ties, permanent home, or center of vital interests. A person might spend less than half the year in a country but still be deemed a tax resident if their spouse and children live there or if they maintain a permanent residence. Misjudging this status can lead to incorrect filings, missed deductions, or unexpected tax bills. To avoid confusion, consult a cross-border tax specialist who can analyze your specific circumstances and help you establish a clear timeline of residency changes.

Record-keeping is essential for long-term compliance. Maintain organized files of bank statements, property deeds, investment summaries, tax returns, and immigration documents. These records not only support accurate reporting but also serve as evidence in case of an audit. Digital backups stored securely in the cloud can protect against loss due to fire, theft, or technical failure. The mindset shift here is from short-term convenience to long-term responsibility. Saving a few hundred dollars in taxes today isn’t worth the risk of losing thousands tomorrow in penalties or legal fees. Staying on the right side of two tax systems isn’t about gaming the rules—it’s about respecting them, planning ahead, and building a reputation for integrity with financial authorities. That reputation becomes an invisible asset, one that supports smoother banking, easier credit approval, and greater peace of mind.

Investment Integrity: Keeping Your Portfolio Stable During Transition

Relocation should not mean abandoning your investment discipline. Yet, many immigrants find themselves making impulsive decisions—selling everything before departure or freezing all accounts out of uncertainty. Markets don’t pause for personal transitions, and forced changes to your portfolio can undermine years of careful planning. The key is to maintain investment integrity: preserving diversification, minimizing unnecessary taxes, and adapting your strategy to new realities without losing sight of long-term goals. This requires evaluating which assets to transfer, which to leave in place, and how to manage currency exposure during the shift.

Forced sales are one of the biggest threats to portfolio stability. Selling investments simply because you’re moving can trigger capital gains taxes, especially if the assets have appreciated in value. In some cases, the tax bill alone can consume a significant portion of the proceeds. Instead of liquidating everything, consider which holdings can remain productive in their current form. For example, dividend-paying stocks or bond funds generating steady income may continue to serve their purpose even if you’re no longer resident in the country. As long as you comply with tax reporting requirements, there’s no need to sell simply because you’ve changed addresses. The same applies to retirement accounts, which often have special rules about early withdrawal penalties and tax treatment across borders.

Currency mismatch is another challenge. If your investments are denominated in a currency that’s weakening relative to your new country’s currency, your purchasing power declines. Conversely, if you transfer funds into a stronger currency too early, you risk missing out on favorable exchange rate movements later. A balanced approach involves holding a mix of currencies aligned with your spending needs. For instance, if you plan to live in Canada, holding part of your portfolio in Canadian dollars can reduce exchange rate risk for daily expenses, while maintaining exposure to other currencies for long-term growth. Currency-hedged investment products, though not always suitable for individual investors, may offer protection in volatile environments.

Regulatory incompatibility can limit access to certain investment vehicles in your new country. Some mutual funds, ETFs, or private investment structures may not be available or legally permissible for foreign investors. In such cases, you may need to restructure your portfolio to fit within local regulations. This doesn’t mean starting over—it means adapting. Work with a financial advisor familiar with both your origin and destination markets to identify equivalent or alternative investments that match your risk tolerance and return objectives. Passive strategies, such as index-based funds or diversified portfolios of global stocks and bonds, often provide simplicity and stability during transition, reducing the need for frequent adjustments.

The goal is continuity, not disruption. By thoughtfully managing your investments through the move, you preserve the compounding effect that drives long-term wealth. Stopping contributions, selling at inopportune times, or letting fear dictate decisions can set you back years. Instead, view immigration as a logistical change, not a financial reset. With careful planning, your portfolio can continue growing, supporting your family’s future no matter where you call home.

Emergency Readiness: Planning for the Unplanned

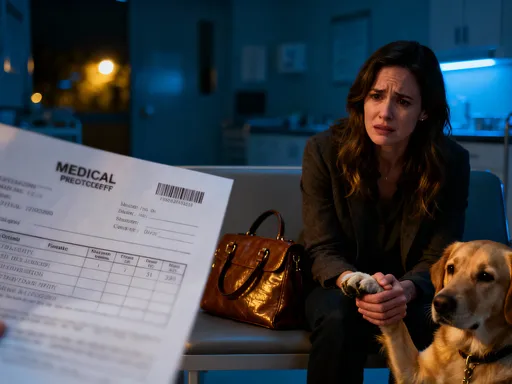

No matter how well you plan, immigration comes with uncertainties. Job offers may fall through, rental agreements may require larger deposits than expected, or medical needs may arise before insurance kicks in. These surprises are not signs of failure—they are normal parts of transition. What separates financial resilience from crisis is preparation. Building emergency readiness into your immigration strategy means ensuring that you have accessible, liquid funds set aside specifically for unforeseen events. This isn’t about predicting every possible problem; it’s about having the means to handle them without derailing your long-term goals.

Experts generally recommend holding three to six months’ worth of living expenses in an emergency fund. For immigrants, however, six to twelve months may be more appropriate, given the time it can take to secure stable employment, establish credit, and understand local systems. This fund should be kept separate from regular savings and invested in low-risk, highly liquid instruments—such as high-yield savings accounts, short-term certificates of deposit, or money market funds. The priority is access, not growth. You need to be able to withdraw funds quickly, without penalties or market fluctuations affecting availability.

Where you hold this fund matters. Ideally, it should be accessible in multiple ways: through a local bank account upon arrival, via an international debit card, or in a currency widely accepted in your new country. Keeping a small portion in cash can also provide immediate relief during power outages, banking delays, or technical issues. However, storing large amounts of cash at home is risky and not recommended. Instead, rely on secure banking relationships and digital access tools that allow you to move money safely and efficiently.

Inflation and political volatility can erode the value of cash holdings, especially in countries with unstable economies. To protect against this, consider holding part of your emergency fund in a stable foreign currency, such as U.S. dollars or euros, particularly if your new country experiences high inflation. Some banks offer multi-currency accounts that allow you to hold and transfer between different currencies, providing flexibility without the risks of carrying physical cash. Additionally, securing international health and property insurance before arrival can prevent small issues from becoming financial catastrophes. These policies may cost more upfront but can save tens of thousands in unexpected medical bills or repair costs.

The mindset shift here is from short-term survival to sustained stability. An emergency fund isn’t just a safety net—it’s a tool for confidence. Knowing you have resources to fall back on reduces stress, improves decision-making, and allows you to navigate challenges with calm and clarity. For women managing family well-being, this sense of control is invaluable. It means you can say no to exploitative job offers, wait for better housing options, or take time to recover from illness without fear of financial collapse. Preparedness doesn’t eliminate risk, but it transforms how you respond to it—turning panic into planning, and uncertainty into opportunity.

The Long Game: Aligning Money Moves with Life Goals

Immigration is not a single event but the beginning of a new financial chapter. The choices made in the first year—how you manage accounts, report taxes, invest, and plan for emergencies—set the trajectory for decades to come. These early decisions influence your ability to build credit, qualify for loans, buy a home, save for retirement, and eventually pass wealth to the next generation. Viewing financial preparation as an ongoing process, rather than a one-time task, allows for greater adaptability and long-term success. The goal is not just survival, but thriving—creating a life of security, opportunity, and legacy in your new home.

Credit history, for example, rarely transfers across borders. Even if you had an excellent score in your home country, you’ll likely start from scratch. Rebuilding credit takes time, but it begins with deliberate actions: opening a secured credit card, paying bills on time, and maintaining low debt levels. Each responsible financial behavior strengthens your profile, opening doors to better interest rates, rental approvals, and eventually, mortgage eligibility. Similarly, retirement planning must be重新 evaluated in light of new tax laws, employer benefits, and pension systems. Contributing to local retirement accounts, such as a 401(k) in the U.S. or an RRSP in Canada, offers tax advantages and compound growth over time. Transferring or coordinating international pensions may require specialized advice, but the effort pays off in long-term security.

Wealth transfer and estate planning also demand attention. Inheritance laws vary significantly between countries, and what was a straightforward will in one place may not be valid in another. Updating legal documents to reflect your new residence, naming local executors, and understanding tax implications for heirs can prevent disputes and ensure your wishes are honored. Life insurance, too, should be reassessed to match your current needs, especially if you have dependents relying on your income.

Avoiding risk isn’t about avoiding action—it’s about acting wisely. The smartest financial moves during immigration are those made with clarity, control, and confidence. They are rooted in knowledge, guided by professionals, and aligned with your deepest values: protecting your family, building stability, and creating a future full of possibility. By treating money not as a source of stress but as a tool for freedom, you reclaim power over your journey. And in that empowerment lies the true reward of starting over—not just surviving, but flourishing.