How I Tamed My Property Tax Bill – Real Strategies That Actually Work

You’re not imagining it—property taxes really do creep up every year. I remember opening my latest assessment notice and nearly spilling my coffee. It felt like I was paying for a mansion I didn’t own. But after digging in, testing appeals, reevaluating exemptions, and learning what assessors actually look for, I cut my bill more than once. This isn’t about loopholes or shady moves—it’s practical, legal planning that anyone can use. If you’ve ever felt blindsided by a tax hike, this guide is for you. Property taxes are one of the most predictable yet overlooked expenses for homeowners, often rising without fanfare but adding up to thousands over time. Unlike income or sales taxes, property taxes are tied directly to your home’s assessed value and local tax rates—two factors that can shift independently of your control. Yet, with the right knowledge and timely action, homeowners can significantly reduce or stabilize what they owe. This article walks through the strategies that worked for me and many others: understanding assessments, appealing unfairly high valuations, claiming every available exemption, timing home improvements wisely, and planning long-term real estate decisions with tax implications in mind. These are not speculative tricks or risky maneuvers—they are grounded in real policy, common procedures, and documented savings. Whether you’ve lived in your home for five years or twenty, there’s likely room to correct errors, claim benefits, or adjust your approach to save hundreds—or even thousands—each year. The key is being proactive rather than reactive. Most people only pay attention when the bill arrives, but the time to act is well before that envelope lands in your mailbox.

The Wake-Up Call: When My Property Tax Jumped

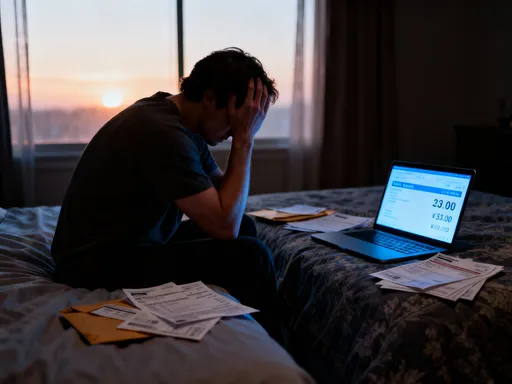

It started with a number on a page—an assessment notice that arrived in late summer, unassuming at first glance. But when I saw the updated valuation, my stomach dropped. My home, which I had purchased seven years earlier for $285,000, was now being assessed at over $460,000. That alone wasn’t shocking—home values had risen across the region. What stunned me was the resulting tax increase: a 22% jump from the previous year, amounting to nearly $1,300 more in annual property taxes. For a household already managing groceries, utilities, and healthcare, that extra burden wasn’t trivial. It equaled an entire month of groceries or two months of internet and phone bills. What made it worse was the feeling of helplessness. I hadn’t made major renovations. I hadn’t expanded the square footage. The market was hot, yes, but my home hadn’t changed—only the number assigned to it had.

That moment became my wake-up call. I realized I had been treating property taxes as an unavoidable fixed cost, like electricity or water. But unlike those bills, property taxes are based on discretionary assessments—estimates made by local officials that can be challenged, corrected, or adjusted. I began to ask questions: Who decided this new value? How was it calculated? Were my neighbors seeing similar increases? Was there any way to respond before the tax became due? I quickly learned that most homeowners don’t know they have rights in this process. They open the notice, wince, and pay—often without realizing they could appeal or qualify for relief. In my case, the increase wasn’t just a reflection of market trends; it was based partly on outdated records, incorrect square footage, and a failure to account for deferred maintenance. Once I uncovered those discrepancies, I realized that ignoring the assessment wasn’t just costly—it was financially irresponsible.

Over the next few months, I committed to understanding the system. I requested my property file from the county assessor’s office, compared it to recent sales in my neighborhood, and attended a public meeting where assessment methods were explained. I discovered that three homes within a half-mile radius had recently sold for significantly less than my new assessed value—homes nearly identical to mine in size, age, and condition. That evidence became the foundation of my appeal. More importantly, I learned that small annual increases, if left unchecked, compound over time. A 3% rise might seem minor, but over a decade, it doubles your tax burden. That slow creep is what catches so many families off guard. By the time they notice, years of overpayment have already occurred. The takeaway? Awareness matters. A single letter of appeal or a quick application for an exemption can reset the trajectory of your tax bill for years to come.

Understanding the Basics: What Drives Your Property Tax Bill?

At its core, your property tax bill is determined by two main components: the assessed value of your home and the local tax rate, often expressed as a millage rate. The assessed value is not necessarily the same as market value—it’s a figure assigned by your local government’s assessor, typically a percentage of the market value depending on jurisdiction. For example, if your home’s market value is $400,000 and your county uses a 90% assessment ratio, the taxable value becomes $360,000. The millage rate, meanwhile, is the amount of tax per $1,000 of assessed value. If your local rate is 15 mills, you pay $15 for every $1,000 of assessed value—so $360,000 would result in a tax of $5,400 annually.

While this formula sounds straightforward, the real-world application is often inconsistent. Assessors use a mix of automated valuation models, recent sale data, and physical inspections to determine value. But these methods aren’t perfect. Data entry errors, outdated property records, or broad neighborhood averaging can lead to inaccuracies. One homeowner might be assessed based on a luxury renovation down the street, even if their own home hasn’t changed. Another might be penalized for a feature that no longer exists—like a deck that was removed years ago but still appears in the assessor’s database. These small discrepancies can add up to hundreds or even thousands in overpayment.

Another factor that surprises many homeowners is the frequency of reassessments. Some counties reassess every year, others every three or five years, and some only after a property sale. If your area hasn’t reassessed in years, your tax might suddenly jump when values are updated to reflect current market conditions. Conversely, in rapidly appreciating markets, even annual reassessments can lag behind real prices, leading to delayed but steep increases. Local government budgets also play a role. When cities or school districts need more revenue, they may increase millage rates—even if property values remain flat. This means your taxes can rise even if your home hasn’t gained value.

The takeaway is this: your tax bill is not a fixed or inevitable number. It’s the product of human decisions, data inputs, and policy choices—all of which can be reviewed, questioned, and sometimes changed. Understanding this structure empowers you to look beyond the final dollar amount and examine the components that build it. When you know how assessed value and millage rates interact, you’re better equipped to spot anomalies, compare fairly with neighbors, and take informed action. Knowledge, in this case, is not just power—it’s potential savings.

The Appeal That Worked: Challenging Your Assessment the Right Way

My first successful appeal began with research, not emotion. After receiving the high assessment, I didn’t call the assessor’s office angry or demand a reduction outright. Instead, I gathered evidence. I visited the county assessor’s website and pulled the public records for my property and nearby homes. I looked for recent sales—ideally within the past six to twelve months—of homes similar to mine in size, age, number of bedrooms, and lot size. I found three: one sold for $410,000, another for $415,000, and a third for $405,000. All were in good condition, with updates comparable to mine. Yet my assessed value was $460,000—nearly 15% higher than recent sale prices. That discrepancy was my starting point.

I then reviewed my own property record for errors. The assessor listed my home as 2,400 square feet, but the original blueprints and appraisal at purchase showed 2,250. That extra 150 square feet, valued at roughly $100 per square foot in my market, added $15,000 to the assessed value. I also noticed that the record listed a finished basement, which I had never completed. Correcting these inaccuracies alone could reduce my valuation by over $20,000. I compiled photos, floor plans, and sale comparables into a packet and submitted it with the official appeal form before the deadline—typically 30 to 60 days after the notice is mailed.

The hearing was low-key. I presented my evidence calmly, focusing on facts rather than frustration. I showed the sale prices of comparable homes, pointed out the square footage error, and explained the unfinished basement. The assessor’s representative reviewed my documents and asked a few clarifying questions. Two weeks later, I received a revised notice: my assessed value had been lowered by $38,000, and my tax bill dropped by $570 annually. That single appeal paid for itself many times over.

The lesson? Appeals are not adversarial battles—they are fact-based reviews. Most jurisdictions encourage them as a way to ensure fairness and accuracy. Success doesn’t require legal expertise or expensive consultants. It requires preparation, attention to detail, and timeliness. You don’t need to win every time; even a partial reduction can yield lasting savings. And because assessments often carry forward, a successful appeal this year can prevent automatic increases in the next. The key is acting early, gathering solid evidence, and presenting it clearly. If you’ve never appealed, you may be overpaying simply because no one has ever questioned the numbers.

Exemptions and Deductions: Are You Leaving Money on the Table?

One of the most overlooked opportunities for tax savings is the range of exemptions available to homeowners. These are not secret loopholes—they are official programs designed to reduce tax burdens for specific groups, yet many qualify without knowing it. I discovered this when a neighbor mentioned she paid hundreds less than me despite living in a nearly identical home. After some digging, I learned she had a homestead exemption, which I hadn’t applied for. In my state, the homestead exemption reduces the taxable value of a primary residence by up to $50,000. For me, that meant a reduction of about $750 in annual taxes—money I had been overpaying for years.

Homestead exemptions are the most common, but they’re not the only ones. Senior citizens, typically those aged 65 and older, may qualify for additional freezes or reductions. Some counties stop increasing the assessed value for seniors, even as market prices rise. Veterans, especially those with service-connected disabilities, can receive substantial exemptions—sometimes up to 100% of assessed value, depending on the state. Even agricultural landowners or those with solar installations may be eligible for credits. These benefits vary widely by location, but the savings can be significant. Missing them is like leaving a refund check uncashed.

Applying is usually simple. Most require a one-time application with basic documentation—proof of age, veteran status, or residency. Once approved, the exemption automatically applies each year. Some programs, like senior freezes, may require annual renewal or income verification, but the effort is minimal compared to the payoff. I applied for both the homestead and senior exemption (once I turned 65) and saw my effective tax rate drop by nearly 20%. Over a decade, that’s thousands in savings.

The challenge is awareness. Local governments don’t always advertise these programs aggressively. Notices may arrive in small print or be buried in tax statements. Real estate agents rarely mention them during home purchases. The responsibility falls on the homeowner to investigate. Start by visiting your county assessor’s website or calling their office directly. Ask specifically: “What exemptions do I qualify for?” Don’t assume you don’t qualify based on income, age, or property type. Rules change, and eligibility may surprise you. Taking an hour to research could save you hundreds every year—forever.

Timing and Improvements: When Renovations Backfire on Taxes

I learned the hard way that not all home improvements are tax-neutral. A few years ago, I remodeled my kitchen—new cabinets, quartz countertops, stainless steel appliances. It was a joy to use and added real quality to daily life. But at the next reassessment, my taxable value increased by $28,000. The assessor didn’t see a happier family—they saw a higher-valued property. That translated into an extra $420 in annual taxes. While I still believe the remodel was worth it, I now realize timing and type of renovation matter.

Most jurisdictions reassess after major improvements, especially those that add square footage or upgrade key systems. A finished basement, an added bathroom, or a new roof can all trigger a value adjustment. Even exterior upgrades like a new driveway or high-end siding may be noticed during aerial reviews or street-level assessments. The irony is that while you invest money to improve your home, you also increase your tax obligation. Over time, those incremental hikes accumulate. A series of well-intentioned projects can result in a tax bill that’s hundreds higher than it would have been otherwise.

The solution isn’t to avoid improvements—it’s to plan them strategically. Consider delaying major renovations just before a scheduled reassessment. In some areas, assessors conduct county-wide reviews every few years. If you know one is coming, you might postpone non-urgent projects until after it passes. Alternatively, focus on upgrades that add enjoyment without significantly increasing value—like landscaping, painting, or interior decor. These enhance livability but are less likely to trigger a reassessment. You can also consult your local assessor’s office to understand which improvements are most likely to affect valuation. Some counties provide guidelines or even pre-assessment consultations.

Another approach is to spread improvements over time. Instead of doing a full kitchen and bathroom remodel in one year, stagger them across multiple tax cycles. This prevents a single large jump in assessed value. You still get the benefits of modernization, but without the tax shock. The goal isn’t to hide improvements—it’s to manage their financial impact. By aligning your renovation schedule with assessment cycles, you maintain control over your tax trajectory. Smart timing doesn’t reduce the joy of a beautiful home; it protects your budget from unintended consequences.

Long-Term Planning: Using Tax Trends to Shape Your Real Estate Moves

Property tax isn’t just an annual bill—it’s a long-term financial variable that should influence where and when you buy, sell, or downsize. I realized this when comparing two neighborhoods with similar home prices but vastly different tax rates. One area had a millage rate nearly 40% higher than the other. Over a 20-year mortgage, that difference amounted to more than $30,000 in additional taxes. Even if home values appreciated slightly faster in the high-tax area, the net equity gain was eroded by the heavier tax burden. This insight changed how I viewed real estate decisions.

When I later considered downsizing, I didn’t just look at home prices—I analyzed tax histories. I studied how assessments had changed over the past decade in different towns, whether school district funding models were driving rate increases, and which areas offered senior freezes or homestead protections. I found a community where taxes were lower and more stable, with a strong track record of limiting annual increases. Moving there reduced my tax bill by 30%, even though the new home was comparable in size and condition.

This kind of planning turns homeownership into a more strategic wealth-building tool. A lower tax bill means more disposable income, faster equity accumulation, and greater financial flexibility in retirement. It also reduces the pressure to sell due to unaffordable taxes—a real concern for fixed-income households. By factoring taxes into long-term decisions, you avoid being locked into a home that becomes financially unsustainable. Real estate isn’t just about location, location, location—it’s also about taxation, taxation, taxation. Understanding trends allows you to anticipate changes, not just react to them. Whether you’re planning to stay for decades or considering a future move, reviewing tax patterns is as important as checking schools or commute times.

Avoiding the Traps: Common Mistakes That Cost Homeowners

Many homeowners lose money not because they lack options, but because of simple oversights. The most common mistake is ignoring the assessment notice. These letters often arrive with little fanfare and are tossed aside. But they contain critical information—your assessed value, appeal deadlines, and exemption opportunities. Missing the appeal window, typically 30 to 60 days after mailing, means accepting the valuation for that year. In some cases, it also locks in the higher value for future years, as assessors may use it as a baseline.

Another trap is assuming your tax bill is final. Some believe that once the number is printed, there’s nothing to do. But most jurisdictions allow appeals, corrections, and exemption applications year after year. Even if you missed last year’s deadline, you can act this year. Others assume they don’t qualify for exemptions based on outdated information. For example, some think the homestead exemption is only for first-time buyers, when in fact it’s often available to any primary resident. Veterans may not realize their eligibility extends beyond wartime service.

Yet another error is failing to verify property records. Many never check the assessor’s database until they receive a shocking bill. By then, errors have compounded. Regular review—once a year—can catch issues early. Finally, some homeowners hesitate to appeal out of fear of retaliation or complexity. But the process is designed to be accessible. Assessors expect appeals and handle them routinely. There’s no penalty for filing, and many reductions are granted based on clear evidence. The real risk lies in inaction. Every year you overpay, you lose money that could have been saved, invested, or used for family needs. Avoiding these traps isn’t complicated—it’s a matter of awareness, consistency, and a little proactive effort.

Conclusion: Taking Control, One Assessment at a Time

Owning a home means more than a mortgage—it means managing your tax responsibility like a savvy investor. My journey from frustration to control didn’t require special connections or legal expertise. It took research, attention to detail, and the willingness to ask questions. Each step—appealing an unfair assessment, claiming overlooked exemptions, timing renovations wisely, and planning with taxes in mind—added up to meaningful, lasting savings. These actions didn’t just reduce my annual bill; they gave me greater confidence in my financial decisions.

This isn’t about gaming the system or avoiding responsibility. It’s about fairness, awareness, and discipline. Property taxes fund essential services like schools, roads, and emergency response—services we all rely on. But no homeowner should pay more than their fair share due to errors, ignorance, or inaction. The system works best when citizens are informed and engaged. When you understand how assessments are made, what exemptions exist, and how to navigate the process, you stop being a passive payer and start building smarter wealth.

The strategies outlined here are available to anyone, regardless of income or location. They don’t promise overnight riches, but they do offer real, measurable relief. A few hours of effort each year can save hundreds, even thousands, over time. More importantly, they foster a sense of control in an area of personal finance that often feels out of reach. Your home is likely your largest asset. Protecting its value means protecting yourself from unnecessary costs. By taking charge of your property tax, you’re not just saving money—you’re investing in your financial peace of mind.