How I Built a Side Hustle That Actually Pays — No Gimmicks, Just Real Financial Skills

Ever feel like your 9-to-5 just isn’t enough, but don’t know where to start making extra money? I was there—stuck, stressed, and spending hours on “get-rich-quick” schemes that went nowhere. Then I shifted my mindset and focused on building real financial skills. It wasn’t overnight, but slowly, I created a part-time income stream that actually works. This is how I did it—and how you can too, without risking everything or falling for hype. The truth is, most side hustles fail not because people lack effort, but because they lack financial clarity. This story isn’t about shortcuts. It’s about strategy, discipline, and the quiet power of knowing how money really works.

The Reality Check: Why Most Side Hustles Fail

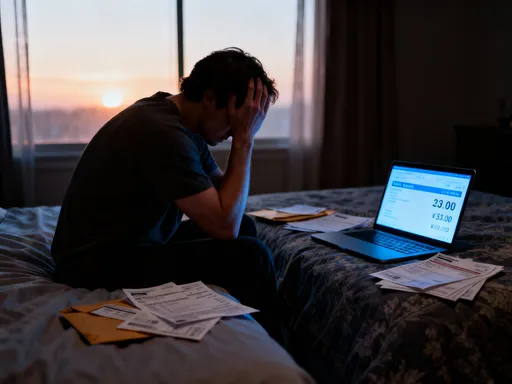

Many people dive into side hustles with high hopes and little planning, only to find themselves months later with no real progress and a growing sense of frustration. The dream of extra income often crashes against the reality of poor execution, unclear goals, and financial mismanagement. Studies show that over 70% of side ventures never generate consistent profit, not because the ideas are bad, but because the foundation is weak. The gap between effort and outcome is rarely about laziness—it’s about a lack of financial literacy. Without understanding basic concepts like cost structures, breakeven points, or cash flow timing, even the most passionate side projects can collapse under their own weight.

One common mistake is treating a side hustle like a hobby rather than a business. People invest time and money without tracking expenses or measuring return on effort. They may spend $300 on supplies, attend networking events, or upgrade tools, only to earn $150 in sales—unaware they’ve already lost money. Others set unrealistic income targets, expecting $2,000 a month within weeks, and become discouraged when results don’t match expectations. The emotional toll of repeated failure can be just as damaging as the financial loss. Without a clear understanding of how money moves in and out of a venture, even small mistakes compound over time.

Another major reason side hustles fail is the lack of a sustainable model. Many people chase trends—dropshipping, print-on-demand, or social media influencing—without assessing whether they have the skills or resources to compete. These models often require marketing expertise, upfront capital, or significant time investment, all of which can be overwhelming for someone already working full time. The result is burnout, not profit. What separates those who succeed from those who quit is not luck, but preparation. Success comes from aligning effort with financial awareness, not just hoping for a breakthrough. Recognizing these pitfalls early allows you to avoid them, build smarter systems, and focus on what truly drives results: real skills, not empty promises.

Skill Over Hype: What Truly Drives Part-Time Earnings

While flashy online courses and viral success stories promote the idea that anyone can make thousands with minimal effort, the reality is far more grounded. Lasting side income doesn’t come from following trends—it comes from mastering fundamental financial skills. These include budgeting, managing cash flow, understanding pricing strategies, and having basic investment awareness. These are not complex Wall Street concepts; they are practical tools that anyone can learn and apply, regardless of income level or education. When you shift from chasing shortcuts to building competence, your earning potential increases not by chance, but by design.

Take the example of Maria, a school administrator earning a steady but modest salary. She wanted extra income to save for her children’s education. Instead of jumping into a trendy online business, she started by analyzing her skills and expenses. She realized she was good at organizing events and managing schedules—skills she used daily at work. She also noticed that local families often struggled to plan birthday parties or small gatherings. With this insight, she launched a weekend event coordination service for private celebrations. She didn’t need expensive equipment or a website right away. Instead, she used free tools to manage bookings and kept her initial costs under $100.

What made her side hustle work wasn’t just the idea—it was her financial discipline. She set clear pricing based on time and materials, tracked every expense, and reinvested profits wisely. Within six months, she was earning an additional $800 a month, consistently. More importantly, she understood her profit margins, knew when to raise prices, and avoided overspending on unnecessary upgrades. Her success wasn’t due to luck or viral marketing. It came from applying budgeting and pricing principles she had learned through online financial literacy courses. By focusing on skill development first, she built a business that could grow sustainably, not just survive on short-term enthusiasm.

This approach transforms the side hustle from a gamble into a predictable process. When you understand how to price your time, manage costs, and forecast income, you reduce uncertainty. You stop relying on random opportunities and start creating your own. Financial skills give you control. They allow you to evaluate opportunities with clarity, avoid common pitfalls, and make decisions based on data, not emotion. In a world full of noise, the quiet mastery of money management becomes your greatest advantage.

Finding Your Profit Zone: Matching Skills to Opportunities

One of the most effective ways to build a profitable side hustle is not to search for the “next big thing,” but to look inward. Your existing skills, experiences, and interests are often the best starting point for identifying viable opportunities. The key is to find the intersection between what you’re good at, what people are willing to pay for, and what you can realistically manage alongside your main job. This sweet spot—the profit zone—is where sustainable income begins. It’s not about becoming an expert overnight, but about leveraging what you already know and refining it into a service or product that meets real demand.

To find your profit zone, start with a simple self-assessment. List your core skills—both professional and personal. Are you organized? Good at writing, teaching, or fixing things? Do you enjoy baking, crafting, or advising others? Next, consider which of these skills solve a problem or fulfill a need. For example, if you’re good at managing schedules, people may pay for help with calendar organization or personal assistant tasks. If you’re skilled in cooking, meal planning or home catering could be a fit. The goal is not to invent something entirely new, but to identify how your strengths can be monetized in a practical way.

Once you’ve identified potential skills, evaluate them based on three factors: time investment, scalability, and financial return. A service like freelance writing or virtual bookkeeping can be done in a few hours a week and has clear pricing models. On the other hand, starting a physical product business may require more upfront cost and ongoing management. Consider how much time you can realistically dedicate—most successful side hustlers start with 5 to 10 hours per week. Choose an option that allows you to test the market without overextending yourself. For instance, offering a few coaching sessions or launching a small batch of handmade goods lets you gather feedback before scaling.

Market demand is another critical factor. Just because you enjoy something doesn’t mean others will pay for it. Use online platforms to research what people are searching for. Look at community groups, local classifieds, or freelance job boards to see what services are in demand. You might discover that resume editing, home organization, or gardening help are frequently requested in your area. By aligning your skills with actual needs, you increase your chances of generating consistent income. The profit zone isn’t found in hype—it’s found in honesty, observation, and smart alignment.

Managing Risk Without Overthinking It

Starting a side hustle always involves some level of risk, but that doesn’t mean you have to gamble your savings or peace of mind. The key to managing risk is not avoiding it completely, but preparing for it wisely. Most people fear failure because they associate it with financial loss, but with the right strategies, you can minimize exposure and protect your personal finances. The goal is not to eliminate risk—because that’s impossible—but to make informed decisions that keep your main income and stability intact while you explore new opportunities.

One of the most effective ways to reduce risk is to start small. Instead of investing thousands in inventory or equipment, begin with a low-cost version of your idea. Offer your service to a few clients, test your pricing, and gather feedback before expanding. This approach, often called a “minimum viable product,” allows you to validate demand without overcommitting. For example, if you want to start a baking business, begin by taking custom orders from friends and neighbors before renting a commercial kitchen. Each step becomes a learning experience, not a financial leap of faith.

Another crucial step is separating your personal and business finances. Open a dedicated bank account for your side hustle, even if it’s just a simple savings account. This makes it easier to track income and expenses, file taxes correctly, and avoid mixing funds. It also creates a psychological boundary—your side income and costs are no longer part of your household budget, reducing stress and confusion. As your business grows, you can upgrade to a business checking account or use accounting software to stay organized.

Setting a realistic budget is equally important. Decide in advance how much you’re willing to spend on your side hustle—whether it’s $100, $500, or $1,000—and stick to it. Include costs like materials, marketing, software, and any fees. If your venture isn’t generating returns within a reasonable timeframe, it’s okay to pause or pivot. Knowing when to walk away is a sign of financial wisdom, not failure. By treating your side hustle like a pilot project with clear limits, you protect your financial health while still pursuing growth. Risk doesn’t have to be scary when you have a plan.

The Cash Flow Mindset: How to Keep Money Moving

One of the biggest reasons side hustles fail—even profitable ones—is poor cash flow management. You can have steady income, but if money isn’t moving efficiently, your business can still collapse. Cash flow is the lifeblood of any venture, big or small. It’s not just about how much you earn, but when you earn it and how you use it. Many side hustlers make the mistake of focusing only on revenue, celebrating every sale without realizing that profit is what truly matters. Revenue is the money that comes in; profit is what’s left after expenses. Without tracking both, you can appear successful on paper while quietly losing money.

Adopting a cash flow mindset means treating your side hustle like a real business from day one. That starts with tracking every dollar—every expense, every payment, every refund. Use a simple spreadsheet or free budgeting app to record transactions weekly. This habit gives you visibility into your financial health and helps you spot patterns. For example, you might notice that certain months are slower, or that a particular service has high demand but low margins. With this data, you can adjust pricing, reduce costs, or shift focus to more profitable areas.

Reinvesting wisely is another key part of cash flow management. When you earn extra income, it’s tempting to spend it immediately—on upgrades, marketing, or personal rewards. But sustainable growth comes from strategic reinvestment. Ask yourself: Will this purchase generate more income? Does it solve a real bottleneck? For instance, buying a better laptop might save time and improve quality, but upgrading to a premium software subscription with limited use may not be worth it. Delay non-essential purchases and prioritize investments that directly support your ability to deliver value.

Building a small operating reserve is also critical. Set aside a portion of your profits—10% to 20%—to cover unexpected costs or slow periods. This buffer prevents you from dipping into personal savings or going into debt when income fluctuates. Over time, consistent cash flow decisions compound into stability. You avoid burnout because you’re not constantly scrambling for money. Instead, you operate with confidence, knowing you have a system that works. Money moves smoothly, and so do you.

Scaling Without Burning Out: When and How to Grow

Growth is often seen as the ultimate goal of a side hustle, but not all growth is healthy. Expanding too quickly can lead to stress, declining quality, and even failure. The goal isn’t to scale at all costs, but to grow in a way that remains sustainable alongside your main job and personal life. Many people burn out because they take on too much too soon—adding clients, launching new products, or working late nights—without adjusting their systems or boundaries. Sustainable growth is gradual, intentional, and balanced.

One of the first signs it’s time to scale is consistent demand. If you’re regularly booked out, turning away clients, or working at full capacity, it may be time to expand. But before adding more, look for ways to work smarter. Can you automate tasks? Use templates, scheduling tools, or outsourcing to free up time? For example, a freelance graphic designer might create standard design packages, use automated invoicing, or hire a virtual assistant for admin work. These small efficiencies allow you to handle more volume without increasing stress.

Time management becomes even more important as your side hustle grows. Set clear boundaries—decide in advance how many hours per week you can dedicate and stick to them. Protect your energy by scheduling work during your most productive times and taking regular breaks. Avoid the trap of thinking that more hours equal more success. Often, focused, high-quality work in fewer hours yields better results. Use time-blocking techniques to structure your week and prevent work from spilling into family or rest time.

Knowing your limits is a sign of strength, not weakness. If growth begins to affect your health, relationships, or main job performance, it’s time to reassess. You can always pause, refine your model, or delegate tasks. The goal is long-term success, not short-term spikes. By growing at a pace that matches your capacity, you build a side hustle that lasts—one that adds to your life instead of consuming it.

Building Wealth Beyond the Paycheck: Turning Side Income into Security

A side hustle is more than just a way to earn extra money—it’s a powerful tool for building long-term financial security. When managed wisely, part-time income can help you pay down debt, build an emergency fund, and start investing in your future. The real value isn’t in the extra cash itself, but in what you do with it. Too often, side earnings are spent immediately on lifestyle upgrades, leaving no lasting impact. But when paired with smart financial habits, that same income can become the foundation of real wealth.

One of the most effective uses of side income is debt reduction. High-interest debt, such as credit card balances, can erode your financial progress. By directing extra earnings toward paying off these obligations, you free up future income and reduce financial stress. For example, earning an additional $500 a month and applying it to credit card debt can save thousands in interest and shorten repayment time significantly. Once debt is under control, the same amount can be redirected toward savings or investments.

Building an emergency fund is another critical step. Most financial experts recommend saving three to six months’ worth of living expenses to cover unexpected events like medical bills or job loss. Side income can accelerate this process, helping you reach your goal faster. Even setting aside $100 a month from your side hustle creates a $1,200 cushion in one year—enough to handle many common emergencies without going into debt.

Finally, side income can be the starting point for investing. You don’t need large sums to begin. Small, regular contributions to low-cost index funds, retirement accounts, or dividend-paying stocks can grow significantly over time thanks to compound interest. For instance, investing $200 a month with a 7% annual return can grow to over $50,000 in 15 years. The key is consistency. By treating your side hustle not as a quick fix but as a long-term financial strategy, you shift from surviving to thriving. You’re no longer just earning extra—you’re building a future of greater freedom and security.