How I Tackled Early Education Costs Without Sacrificing My Future

Remember the first time you saw a preschool invoice and did a double-take? I did. What felt like a small step for my child quickly became a financial leap for our family. Early education costs hit harder than expected, and I realized saving for school wasn’t just about tuition—it was about smarter wealth management. These expenses often begin when budgets are most fragile, and without preparation, they can derail long-term goals. This is the story of how I shifted my mindset, restructured my finances, and built a plan that supports both my child’s development and my family’s future. It’s not about cutting corners—it’s about making intentional choices that last.

The Shocking Reality of Early Education Expenses

For many families, the financial journey of parenthood truly begins not with diapers or strollers, but with the first preschool bill. What many assume will be a modest monthly expense can quickly resemble a mortgage payment. In cities across the United States and other developed countries, full-time daycare or private pre-K programs routinely cost between $10,000 and $20,000 per year—sometimes even more. These figures often surpass the cost of in-state college tuition, yet receive far less public attention or financial aid support. The burden is especially acute for families in dual-income households, where childcare is not optional but a necessity for maintaining employment.

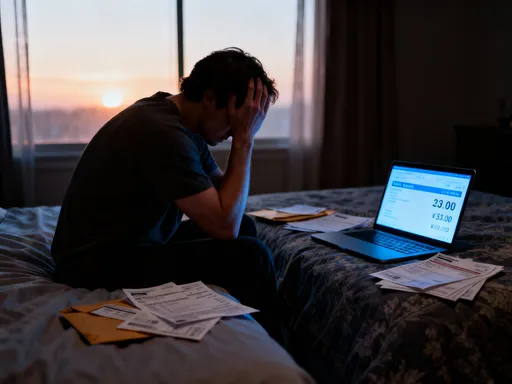

Beyond base tuition, additional expenses accumulate rapidly. Registration fees, supply kits, enrichment programs like music or foreign language classes, field trips, and extended-day care can add thousands more annually. Many programs also charge premium rates for sick-child coverage or last-minute pickups, creating unpredictable costs that strain even well-managed budgets. What begins as a structured monthly payment often evolves into a patchwork of charges that feel unavoidable but are rarely transparent. This lack of clarity makes it difficult for parents to plan effectively, leading to reactive spending rather than strategic budgeting.

The timing of these expenses compounds the challenge. Early education costs typically emerge during the first decade of a family’s financial life—when incomes may still be growing, student debt is being repaid, and homeownership or retirement savings are just beginning. At this stage, families often lack the financial cushion to absorb unexpected or recurring high expenses. As a result, early education spending can crowd out other critical financial goals. Without a proactive strategy, parents may dip into emergency savings, delay retirement contributions, or take on high-interest debt—all to meet what feels like an immediate necessity. Recognizing the full scope of these costs is the essential first step toward regaining control.

Why Wealth Management Starts Earlier Than You Think

Wealth management is often misunderstood as a practice reserved for the affluent or the retired. In reality, it is most powerful when it begins early—especially when major life events like raising children introduce new financial demands. The arrival of early education costs is not just a spending issue; it’s a pivotal moment that tests a family’s financial resilience and long-term planning. Every dollar spent on preschool without a broader strategy is a dollar that could have been invested, saved, or protected for future needs. The real cost of early education is not just what you pay—it’s what you sacrifice in return.

When families treat education as a short-term expense rather than a long-term financial goal, they risk falling into a cycle of reactive decision-making. Delaying retirement savings, pausing debt repayment, or avoiding investments to cover preschool bills may feel necessary in the moment, but these choices have compounding consequences. For example, postponing retirement contributions for five years can result in hundreds of thousands of dollars in lost growth over a lifetime due to the power of compound interest. Similarly, relying on credit cards to cover childcare shortfalls introduces high-interest debt that can linger for years.

The shift in mindset begins with reframing early education as part of a larger wealth-building journey. Instead of viewing tuition as an unavoidable drain, it can be seen as a predictable milestone that fits within a comprehensive financial plan. This approach encourages families to anticipate costs, allocate resources in advance, and protect other financial priorities. It also fosters discipline: when education savings are treated with the same seriousness as mortgage or utility payments, they become non-negotiable. By integrating early education into wealth management early, families not only cover immediate needs but also reinforce habits that support long-term financial health.

Building a Financial Safety Net Before Costs Hit

One of the most effective ways to manage early education expenses is to prepare before they arrive. Waiting until enrollment season to start saving is like waiting until a storm hits to buy an umbrella—possible, but far less effective. Proactive planning allows families to spread costs over time, avoid financial shock, and maintain stability in other areas of their budget. The foundation of this preparation is a dedicated education fund, established well in advance of any formal enrollment. Even small, consistent contributions in the early years of a child’s life can grow into a meaningful cushion by preschool age.

Creating this safety net begins with setting a realistic savings target. Parents can research average costs in their area, account for inflation, and determine how much they’ll need over one or more years of early education. Once a goal is set, the next step is to automate contributions. Setting up a monthly transfer—whether $50 or $200—into a high-yield savings account ensures consistency without requiring constant attention. These accounts offer better interest rates than traditional savings while maintaining liquidity, making them ideal for medium-term goals. Some families also choose to open dedicated 529 plans or Coverdell Education Savings Accounts, which offer tax advantages when used for qualified educational expenses.

Equally important is aligning daily spending habits with long-term goals. This means making conscious trade-offs—such as delaying a home renovation, reducing discretionary dining out, or postponing a vacation—to free up funds for education savings. It also involves redefining what “affordable” means. A prestigious preschool with a waiting list may seem like the best choice, but if it requires draining emergency savings or taking on debt, it may not be sustainable. A more balanced approach considers total cost, financial impact, and long-term consequences. By treating education savings as a fixed expense rather than a discretionary one, families build financial discipline that extends far beyond preschool.

Smart Trade-Offs That Preserve Both Quality and Budget

Quality early education does not have to come at a premium price. While it’s natural to want the best for your child, the definition of “best” should include financial sustainability. Many high-cost programs offer excellent care, but so do many affordable or community-based alternatives. The key is to evaluate programs based on value—what your child gains in development, safety, and socialization—rather than brand reputation or marketing appeal. This shift in perspective opens the door to creative, cost-effective solutions that maintain educational quality without jeopardizing financial health.

One effective strategy is to consider part-time enrollment, especially for younger children. Many three-year-olds do not need full-time care five days a week. A three-day schedule at a high-quality program can provide meaningful learning and social interaction while cutting costs by nearly 40%. As children grow, families can gradually increase hours based on need and budget. Another option is to explore programs offered through local schools, religious institutions, or community centers. These often operate on a nonprofit basis, keep fees lower, and still meet or exceed licensing and curriculum standards.

Shared care arrangements with other families can also reduce expenses. Cooperative preschools, where parents take turns assisting in the classroom, lower staffing costs and tuition. Similarly, nanny shares allow families to split the cost of a qualified caregiver while maintaining a small group setting. These models foster community and often result in more personalized attention than large daycare centers. Additionally, families should take advantage of employer benefits such as dependent care flexible spending accounts (FSAs), which allow pre-tax dollars to be used for childcare. These accounts can save hundreds or even thousands in annual taxes, effectively reducing the net cost of early education.

Equally important is avoiding lifestyle inflation when income increases. It’s common for families to upgrade housing, vehicles, or vacations after a raise or promotion. While these improvements are not inherently wrong, they can crowd out education savings if not managed carefully. A disciplined approach allocates a portion of any income increase directly to long-term goals, ensuring that financial progress supports both present needs and future security. By making smart trade-offs, families can provide excellent early education without compromising their financial foundation.

Investment Approaches That Grow with Your Child

Saving in a standard savings account is a safe and simple approach, but it may not keep pace with rising education costs. Inflation in early childhood education has consistently outpaced general consumer inflation, meaning that money saved today will buy less in five or ten years. To preserve and grow purchasing power, families can consider modest investment strategies tailored to their timeline and risk tolerance. The goal is not to speculate, but to use time as an ally—allowing compound growth to supplement consistent savings.

For families with a longer time horizon—say, five years or more before preschool or private kindergarten enrollment—diversified investments in low-cost index funds or target-date mutual funds can offer meaningful growth potential. These funds spread risk across stocks, bonds, and other assets, reducing exposure to any single market fluctuation. Dollar-cost averaging—investing a fixed amount regularly, regardless of market conditions—helps mitigate timing risks and builds value steadily over time. Even small investments, when started early, can yield significant returns by the time expenses arise.

Tax-advantaged accounts like 529 plans are particularly effective for this purpose. While often associated with college, these accounts can now be used for K–12 tuition up to $10,000 per year, and in some states, for early education expenses as well. Earnings grow tax-free when used for qualified educational costs, and many states offer tax deductions for contributions. This dual benefit—growth and tax efficiency—makes 529 plans a powerful tool in a family’s financial toolkit. Families should research their state’s rules and consider opening an account even if the full benefit isn’t immediately available.

For shorter timelines—less than three years—capital preservation becomes more important than growth. In these cases, low-risk options like high-yield savings accounts, certificates of deposit (CDs), or short-term bond funds are more appropriate. The goal is to protect principal while earning modest returns, ensuring funds are available when needed. The key is alignment: investment strategy should always match the time until expenses are due. By balancing liquidity and growth, families can build a resilient education fund that adapts to changing needs.

Avoiding Common Financial Traps and Emotional Spending

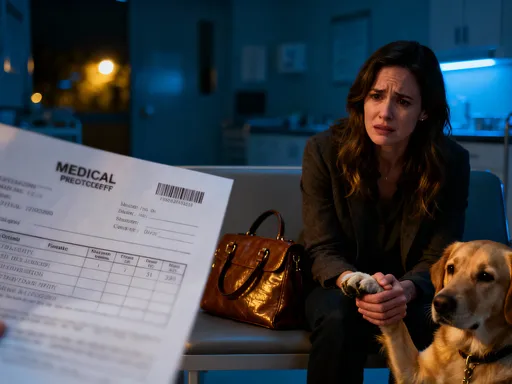

One of the greatest challenges in managing early education costs is not financial—it’s emotional. Parents naturally want the best for their children, and that desire can be exploited by marketing, social pressure, and fear of falling behind. The idea that early advantage leads to lifelong success is pervasive, leading some families to overspend on programs that promise elite outcomes. However, research shows that the quality of care and interaction matters more than the prestige of the institution. A nurturing, responsive environment—even in a modest setting—can support strong cognitive and social development.

Social comparison is another powerful influence. Seeing peers enroll in exclusive preschools or private enrichment programs can trigger feelings of inadequacy or urgency. This fear of missing out (FOMO) often leads to decisions based on emotion rather than financial reality. Marketing campaigns amplify this by emphasizing exclusivity, waitlists, and developmental advantages, creating a sense that anything less is a compromise. The truth is that many high-cost programs offer marginal benefits at best, and the long-term impact on a child’s success is influenced far more by home environment, parental engagement, and later educational experiences.

To avoid these traps, families need a clear financial plan and the discipline to stick to it. This includes setting spending limits, defining what “good enough” means, and having honest conversations about priorities. Regular financial reviews—quarterly or annually—help track progress and adjust for changes in income or expenses. Involving a financial advisor or using budgeting tools can provide objective guidance and reduce emotional decision-making. Most importantly, parents should remember that financial stability is itself a gift to their children. A household free from debt, with emergency savings and retirement planning on track, provides a more secure foundation than any preschool can offer.

Creating a Sustainable, Long-Term Wealth Strategy

True financial success is not measured by how much you spend on early education, but by how well you prepare for the decades ahead. The decisions made today—about saving, investing, and spending—set the trajectory for a family’s long-term well-being. Integrating early education costs into a broader wealth management framework ensures that short-term needs do not undermine long-term goals. This holistic approach balances saving for school with protecting retirement, maintaining insurance coverage, and planning for future milestones like college, homeownership, or unexpected emergencies.

A sustainable strategy begins with a clear vision. Families should define their financial priorities and align them with their values. Is the goal to minimize debt? To retire early? To leave a legacy? Once these goals are clear, education spending can be positioned as one component of a larger plan, rather than an isolated expense. Budgeting tools, net worth tracking, and regular financial check-ins help maintain focus and accountability. Automation—of savings, bill payments, and investment contributions—reduces friction and increases consistency.

Insurance also plays a critical role. Disability insurance, life insurance, and emergency funds protect the family’s financial foundation from unexpected shocks. If a parent becomes unable to work, these safeguards ensure that education savings are not the first to be sacrificed. Estate planning, even in basic form, provides peace of mind by outlining how assets and responsibilities would be managed in difficult circumstances. These elements may seem unrelated to preschool costs, but they are essential to long-term stability.

Ultimately, managing early education expenses is not about sacrifice—it’s about intentionality. It’s about making informed choices that support both a child’s development and a family’s financial future. By starting early, planning carefully, and avoiding emotional traps, families can navigate this challenging phase with confidence. The result is not just a preschool enrollment, but a stronger, more resilient financial life that grows alongside their child.