How I Stopped Putting All My Eggs in One Basket—And You Should Too

What if the biggest threat to your financial future isn’t market crashes, but how you’re investing? I learned this the hard way after watching a chunk of my savings sit stagnant while other assets soared. That wake-up call led me to rethink everything. Asset diversification isn’t just a buzzword—it’s a real strategy that changed how I manage money. In this guide, I’ll walk you through practical cases, lessons from real moves (both smart and silly), and how spreading risk actually helps you sleep better at night. This isn’t about chasing high returns or finding the next big thing. It’s about building a foundation that can weather change, adapt to life’s surprises, and grow steadily over time. If you’ve ever felt anxious about your portfolio or wondered whether you’re doing enough to protect your family’s future, this is for you.

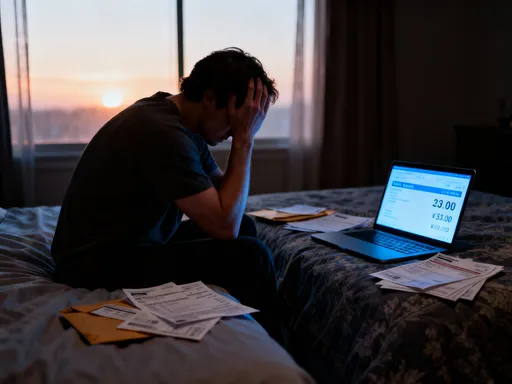

The Wake-Up Call: When My Portfolio Hit a Wall

For years, I believed I was investing wisely. I had a retirement account, some mutual funds, and a few individual stocks I’d picked based on strong performance and glowing headlines. I felt confident—until the numbers stopped moving. It wasn’t a dramatic crash, but a slow, quiet stagnation that lasted over a year. While friends talked about gains in international markets or real estate, my balance stayed flat. That’s when I dug deeper and realized the truth: nearly 70% of my portfolio was tied to a single sector—technology. I hadn’t set out to make such a concentrated bet. It happened gradually. A few early wins in tech stocks made me feel smart, so I added more. Each new investment felt like a continuation of a winning streak, not a growing dependency. But when the sector faced regulatory scrutiny and slowed growth, my entire portfolio felt the drag.

The emotional toll was just as heavy as the financial one. I began checking my account daily, hoping for a rebound that didn’t come. I felt stuck—afraid to sell and lock in losses, but equally afraid to hold on. I started questioning every decision I’d made. Was I too optimistic? Did I misunderstand how markets work? What if this was just the beginning of a longer downturn? The realization hit me hard: I had confused familiarity with safety. Because I understood tech companies and followed their news closely, I assumed I was in control. But real control doesn’t come from knowing a sector well—it comes from structuring your investments so that no single event can derail your long-term goals. That moment of clarity was uncomfortable, but necessary. It forced me to confront a common mistake: mistaking activity for strategy. I had been active—buying, selling, researching—but I hadn’t been strategic. True strategy means thinking ahead, planning for uncertainty, and accepting that no single asset class will win forever.

What kept me from changing sooner wasn’t ignorance—it was fear. Fear of selling at the wrong time, fear of missing out on a recovery, fear of making things worse. I held on because letting go felt like admitting failure. But the real failure was inaction. By staying put, I was allowing my financial health to depend entirely on one slice of the economy. That’s not investing. That’s gambling with blinders on. The wake-up call wasn’t a market crash. It was the silence—the absence of growth while the rest of the world moved forward. And that silence taught me more than any headline ever could.

What Diversification Really Means (It’s Not Just “More Stuff”)

When I first heard the term “diversification,” I thought it simply meant owning more than one stock. I assumed that if I had five different companies in my portfolio, I was safe. But I was wrong. True diversification isn’t about quantity—it’s about quality of exposure. It’s not just having more investments; it’s about having different kinds of investments that respond differently to the same economic events. Think of it like a balanced diet. Eating five types of fruit is better than eating only apples, but it’s still not a complete meal. You need protein, grains, vegetables, and healthy fats to stay strong. Your financial health works the same way. Owning ten tech stocks might feel like variety, but if they all rely on the same economic drivers—like consumer spending on gadgets or corporate spending on software—they’ll likely rise and fall together.

The key concept here is correlation. Two assets are highly correlated if they move in the same direction at the same time. Low or negative correlation means they move independently or even in opposite directions. True diversification means combining assets with low correlation so that when one part of your portfolio struggles, another might thrive. For example, when stock markets dip, bonds often hold steady or even gain value because investors seek safer assets. Real estate might perform well during inflationary periods when stocks struggle. International markets can grow while domestic ones slow. These differences are what make diversification powerful. It’s not about avoiding losses entirely—that’s impossible. It’s about smoothing out the ride so that no single event wipes out years of progress.

Another common misunderstanding is that diversification means complexity. Some people assume they need dozens of investments across obscure markets to be properly diversified. But that’s not true. In fact, overcomplicating your portfolio can backfire. Too many holdings make it harder to track performance, increase fees, and lead to decision fatigue. Simplicity, when done right, is more effective. A well-diversified portfolio might include just four or five core components: domestic stocks, international stocks, bonds, real estate, and cash equivalents. The exact mix depends on your goals, but the principle remains the same—spread risk across different asset classes, industries, and geographies. This doesn’t eliminate risk, but it transforms it from a single point of failure into a manageable, predictable part of the process.

Finally, diversification isn’t a one-time fix. Markets change. Companies evolve. Economies shift. What was a balanced portfolio five years ago might be heavily weighted toward one area today simply because one asset class outperformed. That’s why diversification requires ongoing attention. It’s not about setting it and forgetting it. It’s about regular check-ins, rebalancing when needed, and staying aware of how your investments interact. The goal isn’t perfection—it’s resilience. By understanding that diversification is a dynamic strategy, not a static checklist, you gain the flexibility to adapt and grow without panic when markets shift.

Real Case: From Tech Obsession to Balanced Gains

After realizing how overexposed I was to tech, I knew I had to change—but I didn’t want to panic. I’d seen people make drastic moves during market stress, only to regret them later. So I took a measured approach. My first step wasn’t selling everything at once. Instead, I paused all new investments in tech and redirected future contributions to other areas. This allowed me to gradually reduce my exposure without triggering a wave of taxable gains or emotional decisions. Over the next 18 months, I shifted about 40% of my equity allocation into three new categories: U.S. bond funds, international stock index funds, and real estate investment trusts (REITs). I didn’t pick these at random. Each served a specific purpose in reducing risk and adding stability.

The bond funds were my anchor. They offered lower returns than stocks, but with much less volatility. I chose intermediate-term bond funds because they provided a reasonable yield without taking on excessive interest rate risk. When stock markets dipped, these bonds helped cushion the fall. They didn’t soar, but they didn’t crash either—and that consistency was exactly what I needed. The international funds opened a door I’d ignored for years. I’d always assumed U.S. markets were the safest bet, but that belief was more habit than logic. By adding exposure to Europe, Asia, and emerging markets, I gained access to growth in regions less tied to American economic cycles. When U.S. tech stocks stalled, some of my international holdings actually gained ground, especially in markets with strong manufacturing or commodity sectors.

The REITs were a new experience for me. I’d thought of real estate as something you buy with a mortgage, not something you own through a fund. But REITs allowed me to participate in commercial and residential property markets without managing tenants or repairs. They also provided a steady stream of dividends, which I reinvested to compound growth. What surprised me most was how differently REITs reacted to economic news. While tech stocks swung on earnings reports, REITs responded more to interest rates and employment trends. This lack of correlation was exactly what I was looking for. It meant my portfolio wasn’t all moving in lockstep.

The emotional shift was just as important as the financial one. At first, I missed the thrill of watching tech stocks jump on big news. There’s a certain excitement in high volatility, even when it’s stressful. But over time, I began to appreciate the calm. My portfolio didn’t make headlines, but it grew steadily. I stopped checking it daily. I slept better. And when markets eventually recovered, I realized something important: I hadn’t missed out. My diversified mix still participated in the gains, just without the extreme swings. The lesson was clear—slow and steady isn’t boring. It’s sustainable.

The Hidden Risks Everyone Ignores

Even after diversifying, I made another mistake—one that’s common but rarely discussed. I assumed that because my investments were in different asset classes, they were automatically safe from simultaneous losses. But during a global economic slowdown, I watched nearly all my holdings dip at the same time. How? Because some of them were more connected than I realized. For example, both my international stock fund and my REITs were sensitive to currency fluctuations. When the dollar strengthened, foreign earnings lost value, and property investments tied to global tourism suffered. I hadn’t accounted for that shared risk. This experience taught me that diversification isn’t just about what you own—it’s about understanding *why* they move.

One of the most overlooked risks is overlap. Many funds, especially index funds, hold similar underlying companies. If you own two different S&P 500 funds, you’re not gaining diversification—you’re doubling down on the same 500 companies. Even across asset classes, there can be hidden connections. A tech-heavy bond issuer might suffer when tech stocks fall, dragging down both your stock and bond holdings. Or a commodity price shock might affect both emerging market equities and inflation-protected bonds in unexpected ways. These links aren’t always obvious, especially to investors who rely on fund names rather than digging into holdings.

Behavioral risk is another silent threat. I found myself tempted to “fix” my portfolio every time the news sounded alarming. I’d read about a coming recession and think about selling stocks. Or hear about a booming market and want to chase returns. These impulses, while natural, undermine diversification. The strategy only works if you stick with it through ups and downs. But staying the course requires self-awareness. I started journaling my investment decisions, noting what triggered them—was it data, or emotion? This simple habit helped me recognize patterns and avoid knee-jerk reactions.

Currency risk, geopolitical exposure, and liquidity needs are other factors that often go unnoticed. If you hold foreign assets, exchange rate changes can erase gains. If your investments are too concentrated in one region, political instability could impact returns. And if everything is locked in long-term assets, a sudden expense could force you to sell at a loss. These aren’t reasons to avoid diversification—they’re reasons to do it thoughtfully. The goal isn’t to eliminate every risk, but to understand them, plan for them, and build a portfolio that reflects your real life, not just textbook theory.

How to Build Your Own Diversified Mix (Without Overcomplicating It)

Building a diversified portfolio doesn’t require a finance degree or hours of daily research. It starts with three simple questions: What are your financial goals? How long do you have to reach them? And how much volatility can you handle without panic? Your answers shape everything. If you’re saving for a child’s college in five years, you’ll need a more conservative mix than if you’re planning for retirement 30 years away. If market swings keep you up at night, you’ll benefit from more stable assets, even if they grow slower.

I use a basic framework that adapts to life changes. I divide my portfolio into three buckets: growth, stability, and liquidity. The growth bucket holds stocks—both domestic and international—because they’ve historically delivered the highest long-term returns. The stability bucket includes bonds and dividend-paying funds that provide income and reduce overall risk. The liquidity bucket keeps enough cash or cash equivalents to cover 6–12 months of expenses, so I never have to sell investments in a downturn to cover emergencies. The exact percentages shift over time, but the structure stays the same.

I don’t follow rigid rules like “100 minus your age” for bond allocation. Instead, I review my mix annually and adjust based on major life events—job changes, family needs, market conditions. For example, when I took a career break to care for a parent, I increased my cash holdings and reduced stock exposure. When I returned to work, I gradually shifted back. This flexibility keeps my strategy realistic and personal. I also avoid chasing trends. Just because cryptocurrency or a new market is popular doesn’t mean it belongs in my portfolio. I stick to asset classes I understand and that fit my long-term plan.

Rebalancing is part of the process. Every year, I compare my current allocation to my target. If stocks have grown faster than bonds and now make up a larger share than planned, I sell a portion and reinvest in underweighted areas. This keeps my risk level consistent and forces me to “sell high and buy low” without emotion. I don’t do this monthly or quarterly—once a year is enough for most people. The key is consistency, not frequency. By keeping the process simple and repeatable, I’ve made it sustainable for the long haul.

Tools and Habits That Keep Me on Track

Knowledge isn’t enough—habits make the difference. I’ve built small, consistent practices that keep my portfolio on course without demanding constant attention. The most powerful is automated investing. I set up automatic contributions to my diversified funds every payday. This ensures I invest regularly, regardless of market noise. It also removes the temptation to time the market—a habit that rarely works. Over time, this steady flow of money has done more for my wealth than any single investment decision.

I also use portfolio tracking tools that show my asset allocation at a glance. These visualizers highlight imbalances and make rebalancing easier. I don’t rely on any single platform, but I do check my holdings quarterly to ensure nothing has drifted too far. I pay attention to fees, too. High expense ratios can quietly erode returns, so I compare fund costs and switch when better options emerge. I don’t obsess over saving a few basis points, but I do avoid unnecessary charges that offer no benefit.

One of the most valuable habits is separating emotion from action. I’ve learned to ignore headlines that scream “crash” or “boom.” Instead, I focus on my plan. When I feel anxious, I review my goals and remind myself why I made each choice. I also limit how often I check my account. Daily monitoring fuels stress and impulsive decisions. I look once a month at most—enough to stay informed, not enough to overreact.

Finally, I keep learning. I read books, follow reputable financial educators, and talk to a fee-only advisor every few years for a fresh perspective. I don’t follow gurus or chase tips. But I do stay curious. The economy changes. New tools emerge. What works today might need adjustment tomorrow. By staying engaged but not reactive, I’ve built a rhythm that supports long-term success.

Why This Isn’t a One-Size-Fits-All Fix

Diversification isn’t a magic solution. I’ve tried approaches that failed. At one point, I added niche funds in commodities and emerging sectors, thinking more variety was better. But these were hard to understand, costly, and barely moved the needle. I also experimented with “safe” assets like long-term bonds during low-interest periods, only to lose value when rates rose. These missteps taught me that balance matters more than complexity. A simple, well-structured portfolio beats a complicated one full of obscure bets.

Your path will differ based on your life, goals, and temperament. A young single person with high risk tolerance might lean more into stocks. A parent nearing retirement might prioritize income and stability. That’s okay. The goal isn’t to copy anyone else—it’s to build something that works for you and that you can stick with. Flexibility, self-awareness, and patience matter more than any single tactic.

Investing isn’t about winning fast. It’s about lasting longer. Diversification won’t make you the richest person at the dinner table, but it can help you sleep soundly, stay on track, and reach your goals without crisis. That’s the real win.

Looking back, the best financial decision I ever made wasn’t picking a winning stock—it was learning to stop chasing winners altogether. Diversification didn’t make me rich overnight, but it gave me something better: control, clarity, and peace of mind. The market will always be unpredictable, but your strategy doesn’t have to be. By learning from real cases—especially my own missteps—I’ve built a smarter, more resilient way to grow wealth. And the truth is, you don’t need perfect timing or secret knowledge. You just need to start spreading the risk.