How I Survived a Debt Crisis Without Losing My Mind

I once found myself buried under bills, dreading every email from creditors. It wasn’t one big mistake—it was a series of small oversights that snowballed into a full-blown debt crisis. I tried quick fixes that made things worse. But through trial, error, and real lifestyle shifts, I discovered how powerful cost control can be. This is not a magic solution, but a practical journey from panic to progress—one I wish I’d started sooner. The weight of financial stress can feel isolating, but millions face similar struggles. The difference between drowning and recovering often comes down to mindset, discipline, and a clear plan. What follows is not a get-rich-quick tale, but an honest account of how I rebuilt stability from near collapse—without losing hope or sanity.

The Breaking Point: When Debt Stops Being Manageable

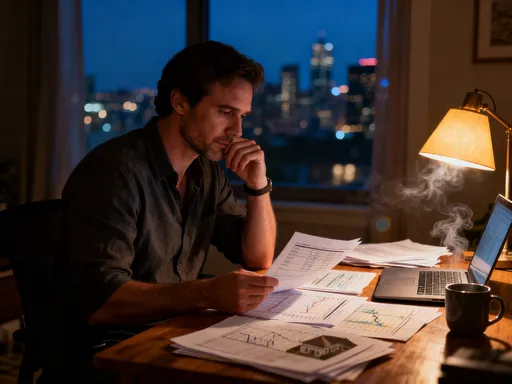

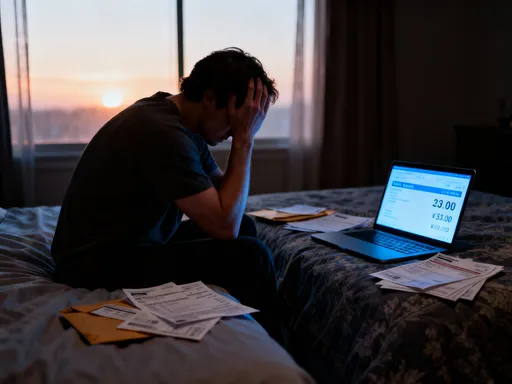

There was a moment, not dramatic in appearance but profound in impact, when I realized I was no longer managing my debt—I was surviving it. It began with a single late payment, then another. At first, I told myself it was temporary, that next month would be better. I had a stable job, after all, and no major emergencies. But the numbers didn’t lie. Credit card balances crept upward, minimum payments barely dented the principal, and new charges kept appearing. Each month, I transferred money from one account to cover another, creating a fragile house of cards.

The emotional toll was just as heavy as the financial one. I stopped opening mail. I muted my phone when creditor calls came through. Sleep became elusive, replaced by cycles of worry and self-blame. I wasn’t spending recklessly—I wasn’t dining at expensive restaurants or buying luxury items. Yet, somehow, I was falling further behind. The realization hit hard: living paycheck to paycheck wasn’t just unsustainable; it was a slow slide into crisis. I had mistaken availability for affordability, assuming that because credit was accessible, I could afford what I charged. That false sense of security masked a growing imbalance between income and outflow.

What made the situation worse was the lack of a clear turning point. There was no single event—no job loss, no medical emergency—that explained the mess. Instead, it was the accumulation of small overspending, deferred decisions, and ignored statements. I had normalized the stress, telling myself that everyone struggles with money. But deep down, I knew this was different. The minimum payments were no longer a temporary fix—they were a trap, keeping me in debt for years while interest drained my resources. That moment of clarity, uncomfortable as it was, became the foundation for change. Admitting I was in over my head wasn’t weakness; it was the first step toward regaining control.

The Hidden Traps: Common Pitfalls That Make Debt Worse

When you're in debt, every decision feels urgent, and many quick fixes promise relief. But some of the most common strategies can deepen the problem rather than solve it. One of the most seductive traps is the balance transfer with a low introductory rate. On the surface, it seems like a smart move—shifting high-interest credit card debt to a card offering 0% for 12 or 18 months. The problem arises when the promotional period ends. Rates can jump to 20% or higher, and if the balance hasn’t been paid off, the remaining debt becomes even more expensive. Worse, people often reuse the original card, thinking they’ve “cleared” it, only to accumulate new charges on top of the transferred balance.

Another hidden trap is the illusion of affordability created by small daily expenses. Buying a $5 coffee every morning, subscribing to multiple streaming services, or eating out a few times a week may seem harmless. But over time, these habits can drain hundreds or even thousands of dollars annually. The issue isn’t the individual purchase—it’s the lack of awareness. These expenses fly under the radar because they don’t feel like big decisions. Yet, when combined with fixed costs and minimum debt payments, they leave little room for progress. I once tracked my spending for a month and was shocked to find I was spending nearly $400 a month on convenience foods and takeout—money that could have gone toward reducing my principal balances.

A third dangerous pattern is borrowing from one account to pay another. This includes using personal loans to pay off credit cards, withdrawing from retirement savings, or relying on home equity lines of credit. While these methods may offer temporary relief, they often shift debt rather than eliminate it. For example, I took out a personal loan to consolidate credit card balances, feeling a wave of relief when the cards were paid off. But within months, I started using them again, convinced I could manage them better. The result? I now had both a loan payment and renewed credit card debt. This cycle, known as debt stacking, is one of the most common reasons people fail to recover. The root issue wasn’t access to credit—it was behavior. Without changing spending habits, any financial tool becomes a temporary bandage on a deeper wound.

Cost Control vs. Cost Cutting: A Mindset Shift

One of the most important lessons I learned was the difference between cost cutting and cost control. Cost cutting implies deprivation—giving up things you value in a desperate attempt to save money. It often leads to frustration and eventual burnout. Cost control, on the other hand, is about making intentional choices based on awareness and long-term goals. It’s not about eliminating joy or comfort; it’s about aligning spending with what truly matters. This subtle shift in mindset made all the difference in sustaining change over time.

For example, I didn’t stop buying groceries, but I started making deliberate choices. I switched to generic brands for items like rice, pasta, and cleaning supplies—savings that added up without sacrificing quality. I began comparing prices across stores and using digital coupons, not out of shame, but as a way to maximize value. These weren’t sacrifices; they were smart decisions. Similarly, I reviewed recurring bills—internet, phone, insurance—and called providers to negotiate lower rates or switch to more affordable plans. In one case, I saved $30 a month on my internet bill simply by asking for a retention offer. These actions weren’t about living with less; they were about getting more for what I was already spending.

Tracking expenses played a key role in this shift. Instead of using it as a tool for guilt, I treated it as a source of insight. I wanted to understand where my money was going, not punish myself for past choices. Over time, patterns emerged. I noticed that certain times of the month—around birthdays or holidays—spending spiked. With that knowledge, I started planning ahead, setting aside small amounts in advance. This proactive approach reduced last-minute stress and prevented reliance on credit. Cost control also meant recognizing emotional spending. There were days when I felt overwhelmed and would impulsively buy something to feel better. By identifying those triggers, I developed alternative coping strategies—going for a walk, calling a friend, or journaling—breaking the link between stress and spending.

Building a Realistic Budget That Actually Works

Most budgeting advice fails because it’s too rigid. It assumes people will stick to a perfect plan without accounting for real-life fluctuations. I tried several popular budgeting methods—50/30/20, zero-based, envelope systems—but kept falling off track. The problem wasn’t my discipline; it was the lack of flexibility. What finally worked was creating a behavior-based budget—one that reflected my actual habits, not an idealized version of myself.

I started by categorizing expenses into three groups: fixed, variable, and discretionary. Fixed expenses included rent, car payment, insurance, and minimum debt payments—amounts that didn’t change much from month to month. Variable expenses covered things like groceries, utilities, and fuel—costs that fluctuated based on usage. Discretionary spending included dining out, entertainment, and hobbies—areas where I had the most control. Instead of setting strict limits, I established ranges based on past spending. For example, I allocated $300–$350 for groceries, knowing that some weeks required more due to sales or meal planning.

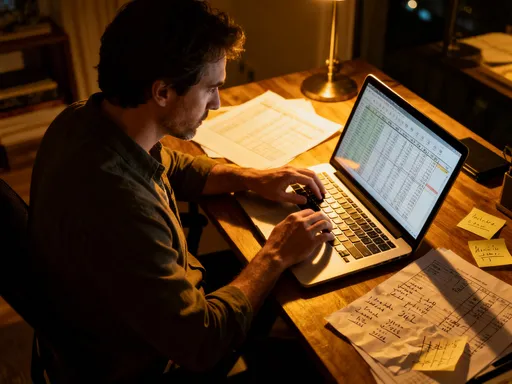

Tracking was essential, but I learned that complexity hindered consistency. I experimented with apps, spreadsheets, and pen-and-paper methods. The most effective tool was a simple spreadsheet with automatic calculations. I updated it weekly, which made it manageable. More important than the tool was the routine. Every Sunday, I reviewed the past week’s spending and adjusted the upcoming week’s plan. This small habit created accountability without feeling overwhelming. I also built in flexibility for irregular expenses—car maintenance, medical co-pays, home repairs—by estimating annual costs and dividing them by 12. I set up a separate savings category and contributed a small amount each month, so when these expenses arose, I wasn’t forced to borrow.

The key to a working budget is sustainability. It shouldn’t feel like a prison. I allowed myself small pleasures—like a weekly coffee treat or a monthly movie—so I didn’t feel deprived. These weren’t budget violations; they were planned expenses. By giving myself permission within limits, I reduced the urge to overspend. A realistic budget isn’t about perfection. It’s about progress, adjustment, and consistency. Over time, I became more confident in my ability to manage money, not because I followed a rigid formula, but because I built a system that worked for my life.

The Role of Emergency Funds in Debt Prevention

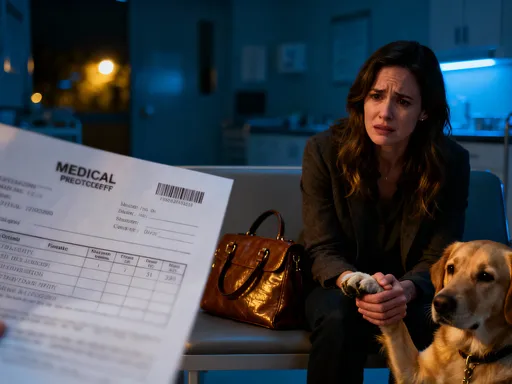

One of the most transformative steps I took was building a small emergency fund—even while I was still paying off debt. For years, I believed I had to be debt-free before saving. But that logic kept me vulnerable. Every unexpected expense—a flat tire, a dental bill, a broken appliance—forced me back into borrowing. I realized I was stuck in a cycle: pay down debt, face an emergency, charge the expense, start over. Breaking that cycle required a shift in priorities.

I started with a modest goal: $500. It wasn’t enough to cover major emergencies, but it was enough to handle small shocks without using credit. I called this my “financial shock absorber.” I automated a $25 transfer each paycheck into a separate savings account. It took time—about eight months—but the impact was immediate. When my car needed new brakes, I paid cash. When a storm damaged my roof, I covered the deductible. These weren’t major disasters, but without that buffer, they would have pushed me deeper into debt.

Once I reached $500, I increased the goal to $1,000. This provided more breathing room and reduced anxiety. I didn’t stop debt payments to build the fund; I adjusted my budget to accommodate both. It meant delaying progress on debt by a few months, but it prevented setbacks that could have added years. Research supports this approach: studies show that even a small emergency fund significantly reduces the likelihood of financial distress. The fund wasn’t about luxury or reward—it was about stability. It gave me the confidence to stick to my budget, knowing I had a safety net. Over time, I expanded it to cover three to six months of essential expenses, but the real breakthrough happened at $500. That small cushion changed my relationship with money. I no longer felt like one emergency away from collapse.

When to Seek Help: Knowing the Limits of DIY Fixes

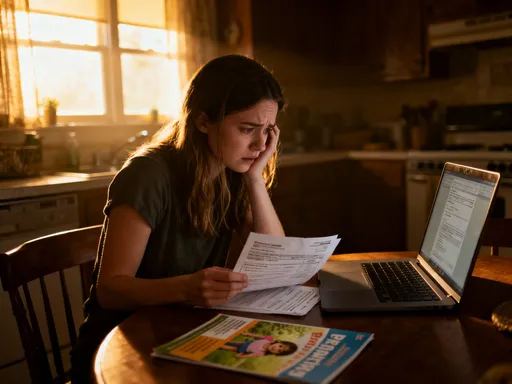

There comes a point when managing debt on your own is no longer enough. I resisted seeking help for months, believing I should be able to fix it alone. But when I missed two consecutive payments and started receiving daily calls from collection agencies, I knew I needed support. Recognizing the limits of DIY solutions isn’t failure—it’s wisdom. Financial stress can cloud judgment, and professional guidance can provide clarity, structure, and access to options you may not know exist.

I began by contacting a nonprofit credit counseling agency accredited by the National Foundation for Credit Counseling (NFCC). These organizations offer free or low-cost consultations and can review your full financial picture. The counselor I spoke with didn’t sell products or push services. Instead, they helped me analyze my income, expenses, and debts, and presented several options. One was a debt management plan (DMP), where the agency negotiates lower interest rates and combines multiple payments into one monthly amount. This simplified the process and often reduced the total interest paid over time.

I also learned about debt consolidation loans—personal loans used to pay off multiple debts, ideally at a lower interest rate. While this can be effective, it only works if you stop using the original credit cards. Otherwise, you risk increasing your total debt. The counselor emphasized the importance of avoiding predatory debt relief companies that promise to “erase” debt for a fee. These scams often charge high upfront costs, fail to deliver results, and can damage your credit further. Reputable help comes from transparent, nonprofit organizations with clear fee structures and certified counselors.

Seeking help allowed me to regain control without shame. It wasn’t a shortcut, but a strategic step. I stayed involved in the process, continued budgeting, and maintained responsibility for my choices. Professional support didn’t solve everything overnight, but it gave me a roadmap and accountability. If you’re facing constant creditor calls, missing payments, or feeling overwhelmed, reaching out is not weakness—it’s a necessary step toward recovery.

Long-Term Stability: Turning Crisis into Lasting Change

Recovering from a debt crisis isn’t just about paying off balances—it’s about transforming your relationship with money. The habits I developed during the hardest months became permanent tools for financial well-being. Monthly check-ins, where I reviewed my budget and progress, helped me stay aware and adjust as needed. Mindful spending—asking myself whether a purchase aligned with my values and goals—replaced impulsive decisions. Automatic savings, even in small amounts, built momentum and security over time.

What surprised me most was how these changes improved other areas of my life. Reduced financial stress led to better sleep, improved focus at work, and more patience in relationships. I wasn’t waiting for a windfall or a raise to feel secure. Stability came from consistency, not sudden change. I also became more intentional about income. I explored side opportunities that fit my skills and schedule, not out of desperation, but as a way to accelerate progress and build resilience.

Avoiding future crises doesn’t require perfection. It requires awareness, preparation, and the willingness to adapt. I still face unexpected expenses and occasional setbacks, but I no longer feel paralyzed by them. I have systems in place, a buffer to absorb shocks, and the confidence that I can navigate challenges. The journey from debt crisis to stability wasn’t fast, and it wasn’t easy. But it was possible—not because of luck, but because of deliberate, repeated choices. Financial peace isn’t the absence of debt; it’s the presence of control, clarity, and resilience. And that, more than any number in a bank account, is the true measure of success.