Love, Money, and the Future: My Remarriage Investment Playbook

Navigating finances after remarriage can feel like walking a tightrope—balancing emotions, responsibilities, and long-term goals. I’ve been there: blending families, merging accounts, and wondering how to protect both our futures. It’s not just about love; it’s about strategy. Through market shifts and personal turns, I learned that smart planning isn’t cold or calculating—it’s the most caring thing you can do. Here’s how foresight turned my second chance into lasting security.

The Emotional Crossroads: Why Remarriage Triggers Financial Reckoning

Remarriage brings joy, companionship, and renewed hope—but it also ushers in complex financial realities that many couples overlook in the early glow of a new relationship. Unlike a first marriage, where financial habits are often formed together from the start, second marriages involve merging established lives, each carrying its own history of savings, debt, career paths, and family obligations. This convergence demands more than emotional compatibility; it requires deliberate financial alignment. The decisions made during this transition can either lay the foundation for lasting stability or plant seeds of future conflict.

One of the most common challenges is the emotional weight attached to money. Past financial disappointments—divorce settlements, poor investments, or strained relationships over spending—can resurface and influence current behavior. A partner who once lost assets in a divorce may resist merging accounts, not out of distrust, but from a desire to protect hard-earned security. Similarly, someone supporting adult children or managing student loan debt may feel anxious about taking on new financial burdens. These feelings are valid, but when unaddressed, they can lead to avoidance, secrecy, or passive-aggressive financial behaviors that erode trust over time.

Transparency is essential, yet it must be approached with empathy. Discussing net worth, credit scores, or past financial mistakes isn’t just a practical step—it’s an act of vulnerability. Couples who normalize these conversations early build stronger foundations. Setting aside dedicated time to share financial histories, without judgment, allows both partners to understand the context behind each other’s choices. This understanding fosters compassion, reduces assumptions, and creates space for collaborative decision-making. It also helps identify potential red flags, such as hidden debt or unrealistic expectations about retirement, before they become crises.

Equally important is establishing shared goals. What does financial success look like in this new chapter? Is it paying off a mortgage, funding grandchildren’s education, or traveling in retirement? Defining these objectives together transforms money from a source of tension into a tool for building a unified future. Without clear, mutually agreed-upon goals, financial decisions risk becoming reactive rather than intentional. By anchoring their plan in shared values, couples can navigate difficult trade-offs—such as whether to downsize a home or support aging parents—with greater clarity and unity.

Forecasting the Future: How Market Trends Shape Second-Chance Planning

While personal choices drive financial outcomes, external economic forces play a powerful role—especially in long-term planning after remarriage. Interest rates, inflation, housing markets, and stock performance don’t operate in isolation; they directly influence mortgage affordability, investment returns, and retirement timelines. Couples who understand these trends—and adjust accordingly—gain a strategic advantage. They avoid locking into high-interest debt during rate spikes, capitalize on market dips, and protect purchasing power in retirement. The key is not to predict the market perfectly, but to build flexibility into the plan so it can adapt as conditions change.

Consider interest rates. When rates are low, refinancing an existing mortgage or taking out a new loan for a shared home becomes more attractive. For remarried couples combining households, this could mean downsizing or relocating to a more affordable area, reducing monthly expenses and freeing up capital for investments. Conversely, when rates rise, holding off on large purchases or shifting toward fixed-rate instruments can prevent overextension. Monitoring the Federal Reserve’s policy shifts and understanding their ripple effects on borrowing costs allows couples to time major decisions wisely.

Inflation is another critical factor. Over time, rising prices erode the value of cash savings and fixed-income investments. For couples nearing retirement, this poses a serious threat to lifestyle sustainability. A seemingly conservative portfolio heavy in bonds or savings accounts may not keep pace with inflation, leading to a gradual decline in real income. To counter this, incorporating inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), or allocating a portion of the portfolio to equities with strong dividend growth can help preserve purchasing power. Diversification across asset classes remains a cornerstone of resilience.

Housing trends also shape financial strategy. In high-cost areas, selling two homes after remarriage may generate significant equity, but reinvesting that capital wisely is crucial. Simply buying a larger home without considering tax implications or maintenance costs can strain budgets. Alternatively, using the proceeds to pay down debt, fund retirement accounts, or invest in income-generating assets creates long-term value. Real estate decisions should align with broader financial goals, not just lifestyle desires. By viewing housing as both a personal and financial decision, couples make choices that support stability rather than short-term comfort.

Market volatility, while unsettling, can also present opportunities. Periods of correction often allow disciplined investors to buy quality assets at lower prices. For couples with a long time horizon, maintaining a consistent investment approach—through dollar-cost averaging or rebalancing—helps smooth out market fluctuations. Emotional reactions, such as panic selling during downturns, can do more harm than good. Staying informed without becoming reactive is the hallmark of sound financial stewardship in a remarried household.

Asset Blending Without Burning Bridges: Smart Integration Strategies

One of the most sensitive aspects of remarriage is how to handle assets. Should everything be merged? Should each partner keep separate finances? There is no one-size-fits-all answer, but a thoughtful, tiered approach often works best. Many successful blended couples adopt a three-account structure: individual accounts for personal spending, a joint account for shared expenses, and goal-specific accounts for major objectives like vacations, home repairs, or retirement. This model balances autonomy with collaboration, reducing friction while promoting fairness.

Protecting pre-marital assets is another priority. Inheritances, property acquired before the marriage, or retirement funds built during a first marriage often carry emotional significance, especially when children from a prior relationship are involved. Titling assets properly—such as holding certain accounts solely in one name or using beneficiary designations—ensures they pass according to intent. For example, a 401(k) or IRA can name children as primary beneficiaries, with the new spouse as contingent, preserving both current partnership and future legacy.

Trusts are another powerful tool. A revocable living trust allows a person to manage assets during life while specifying how they should be distributed after death. For remarried individuals, a qualified terminable interest property (QTIP) trust can provide income to a surviving spouse while ensuring the principal eventually goes to children from a previous marriage. This structure honors both relationships without creating conflict. While trusts involve legal and administrative considerations, their ability to offer control and clarity makes them worth exploring with a qualified estate planner.

Co-investing as a couple can strengthen unity, but it requires clear communication. Whether buying stocks, opening a brokerage account, or investing in real estate, both partners should understand the rationale, risk level, and expected outcome. One partner may be more risk-tolerant, while the other prefers stability. Rather than seeing this as a conflict, it can be an opportunity to build a balanced portfolio that reflects both perspectives. Regular check-ins on investment performance and risk tolerance ensure alignment over time, especially as market conditions or life circumstances evolve.

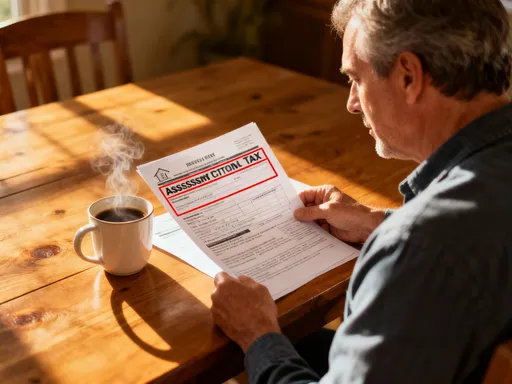

Risk Control in a Shared Life: Insurance, Wills, and Real Talk

Love is built on trust, but legal and financial protections are built on documentation. Too many remarried couples delay or avoid updating wills, beneficiary forms, and insurance policies, assuming these tasks can wait. Yet without proper planning, good intentions can lead to unintended consequences. For instance, failing to update a life insurance beneficiary could result in an ex-spouse receiving the payout, leaving a new spouse or stepchild with nothing. Similarly, dying without a will—intestacy—triggers state laws that may not reflect current family dynamics, potentially excluding stepchildren entirely.

Life insurance plays a vital role in securing a blended family’s future. If one partner earns significantly more, a term or permanent policy can replace lost income and cover living expenses, debts, or education costs. Policies can be structured to benefit both the surviving spouse and children, either through direct naming or placement within a trust. For older couples, final expense insurance may also be considered to cover funeral and medical costs, relieving the burden on heirs.

Healthcare directives and powers of attorney are equally important. These documents allow a spouse to make medical or financial decisions if the other becomes incapacitated. Without them, even a legally married partner may face delays or legal hurdles during a crisis. Naming trusted individuals and discussing end-of-life preferences in advance brings peace of mind. These conversations, while sometimes uncomfortable, reflect care and responsibility, not pessimism.

Updating estate plans after remarriage ensures that wishes are honored. A simple will can outline how assets should be distributed, while a more comprehensive plan may include trusts, guardianship designations for minor children, and instructions for digital assets. Working with an estate attorney ensures that documents comply with state laws and reflect current intentions. Periodic reviews—especially after major life events like births, deaths, or significant financial changes—keep the plan relevant and effective.

Retirement Redefined: Building a Joint Path Without Sacrificing Individual Security

Retirement planning in a second marriage often involves reconciling two different timelines. One partner may be in their early 60s, ready to draw down savings, while the other is still in their 40s, focused on growth. This disparity requires a nuanced approach—one that balances immediate needs with long-term accumulation. The goal is not to force uniformity, but to create a coordinated strategy that respects both timelines and risk tolerances.

Social Security benefits add another layer of complexity. A remarried individual may be eligible for benefits based on a former spouse’s work record, provided the prior marriage lasted at least 10 years and they have not remarried before age 60. After age 60, remarriage does not disqualify someone from claiming these benefits. Strategic filing—such as one spouse claiming spousal benefits while delaying their own—can maximize lifetime income. However, these rules require careful navigation, and consulting a financial advisor familiar with Social Security strategies is highly recommended.

Tax efficiency is crucial when managing retirement accounts. Required minimum distributions (RMDs) from traditional IRAs and 401(k)s begin at age 73 (as of 2024), and failing to take them results in steep penalties. For couples with multiple accounts, coordinating RMDs can help manage tax brackets and avoid pushing income into higher tiers. Converting some pre-tax funds to a Roth IRA over time—a process known as Roth conversion—can reduce future tax burdens and provide tax-free income in retirement. This strategy works best in years when income is lower, such as before full Social Security benefits begin.

Phased withdrawal models offer flexibility. Instead of relying solely on retirement accounts, couples can sequence withdrawals from taxable, tax-deferred, and tax-free accounts to optimize cash flow and minimize taxes. For example, drawing from taxable brokerage accounts first, then tax-deferred accounts, and finally Roth accounts can extend the life of the portfolio while staying in a favorable tax bracket. This approach requires discipline and ongoing monitoring but pays dividends in sustainability.

Raising Kids, Merging Funds: Budgeting for a Blended Family

Adding children—biological or step—into the financial equation transforms budgeting from a couple’s affair into a family enterprise. Daily expenses rise, college savings become a priority, and emotional sensitivities around fairness emerge. The challenge is to support all children equitably without creating resentment or financial strain. The solution lies not in treating everyone identically, but in practicing intentional equity—allocating resources based on need, circumstance, and shared values.

Education funding is often a flashpoint. Parents naturally want to help their children with college, but should stepchildren receive the same support? There is no universal answer, but transparency is key. Having open discussions about what level of support is feasible—and documenting it in a family agreement—prevents misunderstandings. Some couples choose to contribute equally to all children’s 529 college savings plans, while others prioritize biological children for direct funding but leave stepchildren equal inheritances. What matters most is consistency and communication.

Extracurricular activities, summer camps, and even clothing budgets can also spark tension. Establishing clear guidelines—such as covering basics for all children and allowing extras based on availability—promotes fairness. Involving older children in budget discussions teaches financial responsibility and reduces feelings of favoritism. Custodial accounts (UTMAs or UGAMAs) can also be used to set aside funds for minors, giving parents control until the child reaches adulthood.

The ultimate goal is to align financial actions with family values. If education is a priority, then saving for college becomes a non-negotiable line item. If independence is valued, then encouraging part-time work or merit-based aid may be emphasized. By making these principles explicit, couples create a framework that guides decisions without constant negotiation. This reduces stress and builds a culture of shared purpose.

Staying Agile: Regular Financial Checkups for Lasting Harmony

No financial plan survives unchanged over decades. Life evolves—children grow up, careers shift, health changes, and markets fluctuate. What worked five years ago may no longer fit today’s reality. That’s why ongoing review is not optional; it’s essential. Couples who commit to regular financial checkups—quarterly “money dates” and annual deep dives—stay ahead of surprises and maintain alignment. These rituals transform financial planning from a one-time event into a living, breathing part of the relationship.

A quarterly review might take an hour and focus on cash flow, budget adherence, and short-term goals. Are expenses within range? Are savings on track? Is debt being reduced? These conversations don’t need to be formal, but they should be consistent. Using shared budgeting tools or apps can simplify tracking and increase transparency. Celebrating small wins—like paying off a credit card or reaching a savings milestone—reinforces positive behavior and strengthens partnership.

The annual review is more comprehensive. It includes reassessing investment allocations, updating estate documents, reviewing insurance coverage, and recalibrating long-term goals. This is also the time to discuss major upcoming expenses, such as home repairs, college tuition, or retirement transitions. Revisiting risk tolerance—especially as one or both partners age—ensures the portfolio remains appropriate. Market performance should be evaluated, not in isolation, but in the context of the overall plan. Adjustments are made not in reaction to noise, but in service of enduring objectives.

These checkups also provide a safe space to address concerns. One partner may feel uneasy about debt levels, while the other worries about not saving enough. Voicing these fears constructively prevents them from festering. When both partners feel heard and involved, financial decisions become a shared responsibility rather than a source of tension. Over time, this practice builds trust, resilience, and confidence.

Ultimately, remarriage is not just a second chance at love—it’s an opportunity to build a smarter, more intentional financial life. By blending emotional wisdom with practical strategy, couples can create a legacy of security, fairness, and care. The journey requires effort, honesty, and ongoing attention, but the reward is profound: a future where both partners feel protected, valued, and united in purpose. That’s not just good finance—it’s lasting love in action.